PETER’S BUSINESS & FINANCE BRIEFING – Tuesday 10 June 2025, 06:00 Hong Kong

● China’s exports to the US drop the most in more than 5 years ● China’s deflation deepens as economic pressures mount ● Apple announces AI overhaul of its operating system

Tuesday’s Opening Call

Hang Seng (Hong Kong) Projected Open: 24,233 +52 points +0.2%

Nikkei 225 (Japan) Projected Open: 38,270 +181 points +0.5%

Quick Summary - 4 Things To Know Before Asian Markets Open

China’s exports to the US dropped the most in more than 5 years last month. Chinese exports to the US plunged 34.5% from a year ago, marking the sharpest drop since February 2020, according to Wind Information. Imports from the US dropped over 18%, as the country’s trade surplus with the US shrank by 41.6% year-on-year to US$18 billion. Overall, China’s exports growth missed expectations in May. Exports from China rose by 4.8% year-on-year, slightly below analysts’ forecasts of 5.0%. The latest figure marked a sharp slowdown from the 8.1% growth recorded in April, as a jump in shipments to Southeast Asian countries offset a sharp drop in outbound goods to the US.

China’s consumer prices fell for a fourth consecutive month in May, as price wars in the auto sector added to downward pressure. The Consumer Price Index (CPI) fell 0.1% from a year earlier, according to data from the National Bureau of Statistics released Monday. Deflation in China’s factory-gate or producer prices deepened, falling 3.3% from a year earlier in May, a sharper decline than analysts’ expectations for a 3.2% drop. It was the steepest decline since July 2023. Wholesale prices have remained in deflationary territory for 32 months, since October 2022.

US and Chinese negotiators opened their second round of trade talks Monday in London. Xi Jinping agreed to further trade talks with Donald Trump in a phone call last week as there appeared to be a step-back from recent tensions over rare-earth minerals. Donald Trump said Monday he’s “only getting good reports” even though “China’s not easy.” A US official said negotiations will continue Tuesday.

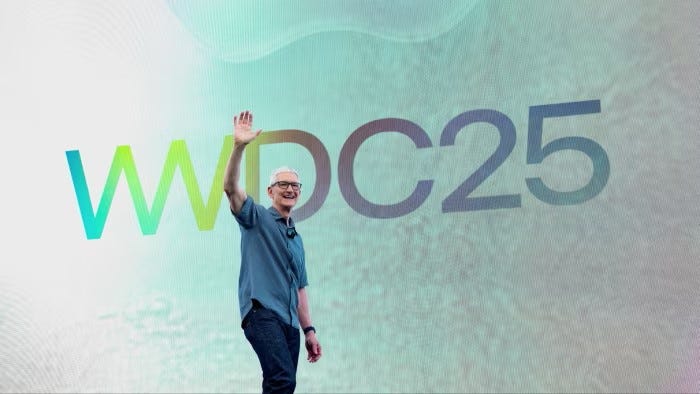

Apple’s annual developer's conference, known as WWDC, kicked off on Monday. Apple said it’s now making new versions of its AI enabled operating systems available for testing. In a keynote speech, Apple CEO Tim Cook announced that Apple will allow millions of app developers to access its artificial intelligence models for the first time, as the tech giant looks to capitalise on its vast hardware and software ecosystem to give it an edge over its competitors. Cook said the company was looking to “harness the power of Apple Intelligence”, referring to an AI overhaul of its software that was first announced at last year’s event.

Week Ahead - June 9th to 15th

This week, top US officials are slated to meet with their Chinese counterparts in London to discuss trade. In addition to the ongoing uncertainty surrounding tariff negotiations, investors will be closely monitoring how the growing rift between President Trump and Elon Musk unfolds. On the economic front, it will be a relatively quiet week in the US. The Labor Department will release consumer price index (CPI) and producer price index (PPI) data from May, providing new readings on how prices have changed as a result of tariff policies. The monthly CPI report comes on Wednesday, and the PPI report is released Thursday. Inflation was relatively mild in April, with the CPI showing annual inflation at 2.3%, but economists expect tariffs to put more pressures on prices in the coming months. On Friday, the University of Michigan’s preliminary consumer survey will be released. The final May reading for the sentiment index showed that Americans are still feeling gloomy about the economy. The data reflected one of the lowest-ever levels, dating back to 1952.

In Asia, inflation readings are expected from India. Carlos Casanova, Senior Economist, Asia at Union Bancaire Privée, Hong Kong wrote in a note Monday, “India's inflation is expected to continue cooling, driven by declining food prices. Favourable monsoon rains and decreasing energy costs should sustain this trend, with the possibility of inflation dropping below the RBI's 2-6% tolerance band in Q2-Q3. Although the bank has shifted to a "neutral" stance, another rate cut remains possible, depending on data developments.”

Elsewhere in the region, Hong Kong industrial production data will be released on Thursday. In Australia, the focus will be on the country’s NAB business confidence and Westpac consumer confidence surveys.

In Europe, Germany will publish wholesale price data, while the UK releases a batch of figures including labour market statistics, April GDP growth, the goods trade balance, and industrial production. On Wednesday, UK chancellor Rachel Reeves presents her spending review statement to parliament.

On the political front, the G7 Leaders’ Summit begins in Kananaskis, Alberta on Sunday, marking the 50th year of the international rich nations club. Hanging over the Canadian summit and testing the relevance of the G7 are tensions over Donald Trump’s tariff war, the Israeli-Hamas conflict in Gaza and Ukraine-Russia negotiations. On Saturday, the EU will mark the 40th anniversary of the signing of the Schengen Agreement, in which Germany, France, Belgium, Luxembourg and the Netherlands agreed to gradually remove border controls. On Wednesday, the Polish government faces a vote of confidence in an attempt by prime minister Donald Tusk to shore up his centre left coalition after the presidential election victory by ultraconservative Karol Nawrocki. Elsewhere in Europe, delegates from nearly 200 UN member states are gathering in Nice to seek to reach consensus around ocean protection. The French and Costa Rican organisers of the gathering hope to secure global implementation of the UN High Seas Treaty, which was agreed in 2023 but has not yet entered into force because too few countries have ratified it.

On the corporate front, Apple’s Worldwide Developers Conference (WWDC) kicks off yesterday with a keynote address from CEO Tim Cook. Apple, which is struggling to make its Siri system work, is facing pressure to deliver on AI. The company overplayed its hand last year and announced key features that it still hasn’t rolled out.

US - China Trade Talks Start In London

US and Chinese negotiators opened their second round of trade talks Monday in London. Donald Trump said Monday he’s “only getting good reports” even though “China’s not easy.” A US official said negotiations will continue Tuesday.

Xi Jinping agreed to further trade talks with Donald Trump in a phone call last week as there appeared to be a step-back from recent tensions over rare-earth minerals. On Saturday, Beijing confirmed that Vice Premier He Lifeng would be leading the Chinese delegation in the London talks. The US side is being represented by Treasury secretary Scott Bessent, commerce secretary Howard Lutnick and US trade representative Jamieson Greer.

Export controls, a major concern for industries worldwide, moved to the top of the agenda of the trade talks. The trade war between Washington and Beijing has in recent weeks veered away from tariffs, focusing instead on each country’s restrictions on material or products the other side desperately needs. The US side is set to press Xi Jinping’s representatives to speed up exports of rare-earth minerals and magnets containing them as they agreed to in Geneva last month. The Chinese team, on the other hand, will push Washington to remove recent restrictions on the sale of jet engines and a variety of technology and other products to China. A key goal for China will be to ease US chip controls.

In a promising sign, Beijing said it’s already approved some rare-earth exports, a priority for Washington but didn’t elaborate on the products’ applications or destinations. Reuters reported on Friday that China has approved temporary export licenses to rare earth suppliers of top US automakers, including General Motors, Ford and Stellantis. It’s unclear what materials are covered by the licenses and at least some are valid for six months, Reuters said.

Kevin Hassett, director of the National Economic Council, said Sunday, “we want the rare earths, the magnets that are crucial for cell phones and everything else, to flow just as they did before the beginning of April. We don’t want any technical details slowing that down.” Hassett said the talks are likely to result in Beijing quickly releasing rare earths for export, and Washington easing China's access to semiconductors. "I expect this to be a short meeting with a big strong handshake," he told CNBC on Monday.

Separately, on Saturday, China’s Commerce Ministry said that it is willing to establish a green channel for qualified applicants looking to sell rare earths to EU companies, so those businesses don’t become collateral damage of US-China trade tensions.

US Trade Team Said To Extend India Stay

A US trade team that’s currently in India for negotiations has extended its stay, according to Bloomberg News Monday, in a sign talks are progressing ahead of a July deadline. The team, which was initially scheduled to hold talks with Indian officials on June 5-6, will now be staying till Tuesday to continue discussions, the report said. Most of the issues may get finalized within a week, Bloomberg sources estimated.

Indian Commerce Minister Piyush Goyal described his meeting with US counterpart Howard Lutnick during a visit to the US in May as “constructive.” Earlier this month, Lutnick said he’s “very optimistic” about prospects for a trade deal between the US and India “in the not-too-distant future.” India was one of the first countries to begin negotiating a trade deal with the US, hoping to avert President Donald Trump’s reciprocal tariffs, which are scheduled to kick in on July 9.

US Companies Push For Lower Vietnamese Tariffs As China Hedge

American companies are urging Washington to lower tariffs on Vietnam, arguing that the south-east Asian country has become a vital part of their “China plus one” diversification strategy, the Financial Times reported Monday. Vietnam was one of the biggest winners from Donald Trump’s trade war in his first term as manufacturers shifted from China. Apple, Intel and Nike are among American companies that rely heavily on Vietnam. As a result of that production shift, the south-east Asian country’s trade surplus with the US ballooned, crossing US$125bn last year and ranking third after China and Mexico. The Trump administration imposed a 46% tariff on Vietnam in April, one of the highest after China, before pausing the levy pending trade negotiations.

“Vietnam has emerged as a valued partner of the United States in the context of diversifying supply chains,” the American Chamber of Commerce in Hanoi said in a letter sent to officials in the US and Vietnam, according to a copy obtained by the FT. While the letter did not mention China, it added, “we urge the US government to consider this deficit trend as evidence of President Trump’s success during his first term in diversifying supply chains in the Indo-Pacific region. We urge the US to avoid retaliatory and sectoral tariff measures against the logical outcome of its own policy goals.” The tariffs are a “critical issue” for US businesses in Vietnam as higher rates would “negatively affect our members’ businesses and customers, and the broader commercial relationship between our two countries”, the chamber said.

Vietnam is crucial to the supply chains of several American companies. It accounts for half of footwear production of Nike, which now plans to raise prices because of the tariffs. Analysts expect Apple to source two-thirds of AirPods from Vietnam by the end of the year.

China Export Growth Misses Expectations

China’s exports growth missed expectations in May, despite a temporary trade truce with the US that prompted businesses to frontload shipments and capitalize on the 90-day pause on steep duties. Exports from China rose by 4.8% year-on-year to US$316.1 billion in May, slightly below analysts’ forecasts of 5.0%. The latest figure marked a sharp slowdown from the 8.1% growth recorded in April, as a jump in shipments to Southeast Asian countries offset a sharp drop in outbound goods to the US.

China’s imports fell 3.4% y/y to US$212.9 billion in May, a sharper decline than April’s 0.2% drop and far worse than economists’ expectations of a 0.9% fall. It marked the fourth consecutive monthly contraction in imports, highlighting subdued domestic demand and the impact of US tariffs, despite a 90-day trade truce. For the first five months of the year, purchases dipped 4.9% to US$1.01 trillion. During that period, imports fell from the US (-7.4%) and the EU (-7.3%) but rose from the ASEAN countries (1.2%).

China’s exports to the US dropped the most in more than 5 years last month. Chinese exports to the US plunged 34.5% from a year ago, marking the sharpest drop since February 2020, according to Wind Information. That's down from -21.0% y/y in April. Imports from the US dropped over 18%, as the country’s trade surplus with the US shrank by 41.6% year-on-year to US$18 billion. However, exports to other regions continued to show solid growth in the month. Exports to ASEAN (14.8%) led the way, while exports to the EU (12.0%) picked up m/m. The acceleration of exports to other economies has helped China's exports remain relatively buoyant in the face of the trade war.

China's trade surplus widened sharply to US$103.22 billion in May, up from US$81.74 billion in the same period a year earlier and surpassing economists’ expectations of US$101.3 billion. Donald Trump’s prohibitive 145% tariffs on Chinese goods took effect in April, with Beijing retaliating with triple-digit duties and other restrictive measures, such as export controls on critical minerals. The US and China struck a preliminary deal in Geneva, Switzerland, last month that led both sides to drop a majority of tariffs. Washington’s levies on Chinese goods now stand at 51.1% while Beijing’s duties on American imports are at 32.6%, according to the think tank Peterson Institute for International Economics.

China’s Consumer Price Deflation Deepens

China’s consumer prices fell for a fourth consecutive month in May, as price wars in the auto sector added to downward pressure. The Consumer Price Index (CPI) fell 0.1% from a year earlier, according to data from the National Bureau of Statistics released Monday, compared with the median estimate for a 0.2% decline among analysts polled by Reuters. The CPI slipped into negative territory in February, falling 0.7% from a year ago, and continued to post year-on-year declines of 0.1% in March and April. On a monthly basis, the CPI declined by 0.2% in May, reversing a 0.1% gain in April and indicating the third monthly drop so far this year. Core inflation, excluding food and energy prices, however, rose 0.6% y/y in May, the highest since January this year.

China's food prices declined by 0.4% year-on-year in May, accelerating from a 0.2% fall in the previous month and marking the fourth consecutive monthly drop. Pork price growth slowed further (3.1% vs 5.0%), with prices expected to remain volatile for the rest of the year amid tightening supply and weakening consumer demand. Non-food prices were flat for the second month in a row, as increases in housing, clothing, healthcare and education were offset by a sharper drop in transport costs.

Deflation in China’s factory-gate or producer prices deepened, falling 3.3% from a year earlier in May, a sharper decline than analysts’ expectations for a 3.2% drop. It was the steepest decline since July 2023. Wholesale prices have remained in deflationary territory for 32 months, since October 2022. Monthly, the Producer Price Index shrank 0.4% in May, matching March's and April’s pace and marking the largest monthly drop in six months. For the first five months of 2025, factory-gate prices fell 2.6%.

The data piled pressure on policymakers as they try to boost domestic demand and negotiate trade tensions with the US. Inflation data in China has for years been close to deflationary territory, raising concerns over consumer confidence and adding to calls for more stimulus from Beijing. Aside from the persistently weak consumer demand, a bruising price war in the automotive industry has kept prices lower, said Zhiwei Zhang, president and chief economist at Pinpoint asset management. Chinese policymakers have urged the automotive industry to halt the brutal price wars, which had hurt businesses’ profitability and efficiency, driving prices lower. “The price war in the auto sector is another signal of fierce competition driving prices lower,” Zhang said, adding that falling property prices also contributed to the downward pressure in consumer prices. While exports have been holding strong, “eventually China needs to rely on domestic demand to fight the deflation,” Zhang added.

Japan Posts Smaller Q1 Economic Contraction Than First Reported

The Japanese economy contracted at a slower pace than expected in the first quarter of 2025, revised estimates released by the Cabinet Office on Monday showed. The country’s GDP fell at an annualized pace of 0.2% in the January to March quarter, compared with a 0.7% decline estimated earlier. Economists polled by Reuters had expected the revised reading to remain the same as the initial data. However, the latest figure marked a sharp reversal from the downwardly revised 2.2% growth in Q4 and represented the first yearly decline in a year.

The contraction was driven in part by a drag from net exports amid rising US tariffs, with Japan’s key automotive sector facing a 25% levy. Government spending also fell for the first time in five quarters, posting the steepest drop in seven quarters. On the positive side, both private consumption and capital expenditure expanded for the fourth straight quarter, with their growth gaining momentum.

Investors are keeping a watch on the Bank of Japan’s monetary policy stance, given that it cut its growth and inflation forecasts for the year at its May 1 policy meeting. The central bank is set to hold a two-day policy meeting next week.

Separately, data showed Japan posted a current account surplus of ¥2,258 billion in April, up from ¥2,188 billion a year earlier, but below economists’ forecasts of ¥2,560 billion. The goods account deficit narrowed significantly to ¥32.8 billion from ¥635.5 billion, as imports totalled ¥8,801.9 billion and exports reached ¥8,769.1 billion. However, the services account deficit widened slightly to ¥768.1 billion from ¥732.9 billion.

Taiwan Export Growth Highest Since 2010

Exports from Taiwan soared by 38.6% year-on-year to a record US$51.74 billion in May, following a 29.9% gain in the previous month. The figure marked the strongest annual growth in export activity since July 2010, driven by a significant rise in shipments for information, communication and auto-video products (111.1%). Exports jumped to the USA (87.4%), followed by ASEAN (52.3%), Japan (17.5%), and Mainland China & Hong Kong (16.6%). For January to May, exports totalled US$229.96 billion, up 24.3% from the same period last year.

Taiwan's trade surplus surged to a record US$12.62 billion in May, more than doubling from US$6.03 billion in the corresponding month of the previous year. For the first five months of the year, Taiwan’s trade surplus reached US$43.45 billion, 38.3% higher compared to the same period last year, with exports growing 24.3% and imports increasing by 21.4%.

Apple’s Annual Developer's Conference Starts

Apple’s annual developer's conference, known as WWDC, kicked off on Monday. The event is expected to introduce redesigned software interfaces for the iPhone, iPad, Mac, Apple TV and Apple Watch including a new visionOS-like design language across its devices called Liquid Glass. In a keynote speech, Apple CEO Tim Cook announced that Apple will allow millions of app developers to access its artificial intelligence models for the first time, as the tech giant looks to capitalise on its vast hardware and software ecosystem to give it an edge over its competitors. Cook said the company was looking to “harness the power of Apple Intelligence”, referring to an AI overhaul of its software that was first announced at last year’s event. Developers would be able to test the features starting on June 9, with a full rollout for consumers in the autumn, Cook said. The AI features are only available on recent models of the iPhone.

Apple software chief Craig Federighi said that opening its AI models to third parties would “ignite a whole new wave of intelligent experiences in the apps users rely on every day”. Federighi gave the example of a puzzle app building a personalised quiz for a user based on the notes on their device, or a hiking app choosing a trail for a user based on their personal preferences when they do not have reception.

Apple is also introducing live AI translation of calls and messages using models running locally on the user’s device, as well as a number of other incremental updates such as allowing its “Visual Search” feature to engage with content on a user’s screen. The latest push into the AI space comes as investors are concerned that Apple risks falling behind in a technological race with the likes of Google, Samsung and Huawei to offer “AI smartphones”. The initial “Apple Intelligence” rollout has hit snags, and a more advanced and conversational Siri voice assistant, announced at last year’s conference, has yet to be rolled out. The company’s shares fell shortly after the conference began, when Federighi said an upgraded Siri voice assistant wasn’t yet available. Apple needs “more time to meet our high quality bar,” he said. In addition to the Siri delay, the company has yet to strike deals with potential AI partners including Google and Chinese competitors Baidu and Alibaba.

Although there was no upgraded Siri, the company added a host of AI features to various devices and services, including a “Workout Buddy” on its smartwatch that can analyse user fitness data and provide encouragement during workouts. Apple also announced a slate of new features for engaging with content in the Vision Pro augmented reality device.

Asian Markets Rise Ahead Of US-China Trade Talks

Asian markets climbed Monday as investors awaited trade talks between Washington and Beijing later in the day, and digested China inflation data. Japan’s Nikkei 225 advanced 0.9% to 38,089 after revised data showed Japan’s GDP contraction in the first quarter was less than first reported. Taiwan’s Taiex added 0.6%. In India the BSE Sensex climbed 0.3% to 82,445, rallying for a fourth day to its highest since mid-May. Australian markets were closed for a public holiday.

In South Korea, the Kospi Index climbed 1.6% to its highest level since July 2024. Global money managers are becoming more optimistic on South Korea’s stock market on hopes new President Lee Jae-myung’s push for shareholder-friendly policies will finally deliver stronger returns. Last week, South Korean equities saw their biggest weekly foreign inflows since March 2024, despite a shortened trading week. Global funds added a net US$1.8 billion in the equity market to mark the second straight week of inflows, according to data compiled by Bloomberg. That has helped to propel the benchmark Kospi Index into a bull market. The Kospi advanced 4.2% in last week’s three trading sessions for the biggest weekly gain since February 2024. The Kospi is up 24.5% from its most recent low on April 9.

Chinese Stocks Listed In Hong Kong Enter Bull Market

Chinese stocks rose on Monday, with mainland stocks reaching multi-week highs as officials from Beijing and Washington were set to resume trade negotiations in London today. Market sentiment was buoyed by reports that China has granted temporary approvals for rare earth exports, while US-based Boeing has resumed commercial jet deliveries to China, signalling an easing of bilateral tensions. Mainland China’s CSI 300 index rose 0.3% to 3,885. Hong Kong’s Hang Seng Index added 389 points, or 1.6%, to an almost three-month high of 24,181. The latest move brings the year-to-date gains for the city’s benchmark index to 20.5%.

Chinese stocks listed in Hong Kong entered a bull market. The Hang Seng China Enterprises Index, which captures the performance of mainland China stocks listed in Hong Kong, was up 1.7%, more than 20% higher than its April 7 low.

The Hang Seng Tech Index surged 2.8%. Top performers include Kingdee International Software, which rose 11.8%, Tencent Music Entertainment Group, up 5.6% and Kuaishou Technology which gained 5.6%. Strong moves were also seen in SenseTime, which advanced 5.0% and Meituan which gained 4.7%.

Investors in Chinese markets are closely watching the outcome of the London trade talks. A temporary trade truce with the US appeared shaky and markets are watching whether Beijing will roll out more monetary easing to boost the economy. In an article published last week, state-run media China Securities Journal said the PBOC may bring down the RRR further later this year to support growth and could soon end a months-long pause on government bond trading. The central bank had paused bond purchases in January in an attempt to curb the plunging bond yields and a weakening currency.

Investors are also waiting for the annual Lujiazui forum to be held later this month in Shanghai, where China’s top financial regulators, including the PBOC governor Pan Gongsheng, will deliver keynote speeches. Shanghai government officials told reporters last month that major financial policies will be revealed at the forum.

Brazil is hoping to sell its first sovereign debt in the Chinese market as soon as this year, as President Luiz Inácio Lula da Silva looks to strengthen trade and investment ties with China. The leftwing administration in Brasília is planning the so-called panda bond, debt issued in Chinese renminbi by a foreign borrower and is also keen to re-enter the euro-denominated bond market, according to deputy finance minister Dario Durigan.

European Markets Close Lower

European stocks closed off their lows but were still down on the day as US and Chinese trade negotiators met in London. The pan-European Stoxx 600 declined 0.1%. The UK’s FTSE 100 fell 0.1%. Nvidia CEO Jensen Huang pledged to boost investment in the country’s artificial intelligence sector at London Tech Week, describing the country as a “Goldilocks” opportunity.

Shares of London-listed chip designer Alphawave surged 18.9% after the company agreed to a US$2.4 billion takeover by US semiconductor giant Qualcomm to expand its technology for artificial intelligence. The California-headquartered firm will pay 183 British pence (US$2.48) per Alphawave Share in an all-cash deal. Qualcomm announced its intention to bid for Alphawave in early April, when Alphawave shares were valued at 94 pence, giving the final cash offer a 95% premium.

US Shares Close Higher For Second Day

US stocks closed higher for a second day Monday as traders waited for an update from the US-China trade talks in London. The S&P 500 index added 0.1% and notched a second winning session, closing at 6,006. The Dow ticked down just 1 point and closed at 42,762. The Nasdaq Composite climbed 0.3% to end at 19,591.

Chip stocks such as AMD (+4.8%) rallied Monday, boosting the tech-heavy Nasdaq. Apple shares lost 1.2% as the company held its 2025 Worldwide Developers Conference, during which it announced its first new iPhone operating system redesign since 2013.

Aviation stocks extended gains after Donald Trump signed an executive order for the development, commercialization and export of drones. Archer Aviation (+10.6%), Joby Aviation (+13.6%), Vertical Aerospace (+14.9%) and Blade Air Mobility (+11.6%) all climbed.

Meta is in talks to make a multibillion-dollar investment into artificial intelligence startup Scale AI, according to Bloomberg News. The financing could exceed US$10 billion in value, making it one of the largest private company funding events of all time. Shares of Meta closed 0.5% lower.

Treasury Yields Slip

The 10-year Treasury yield slipped 3 bps to below 4.5%, with government auctions of 3-year notes, 10-year notes and 30-year bonds slated for later this week. Yields jumped Friday following a better-than-expected jobs report.

US Dollar Lower Ahead Of Key Data

The US Dollar Index edged 0.2% lower to around 99 on Monday, trimming gains from the previous session as investors braced for a busy week of key economic data and trade developments. On the data front, markets are awaiting several major economic releases. The Consumer Price Index is due Wednesday, followed by the Producer Price Index and the University of Michigan’s consumer sentiment report on Friday. The dollar had strengthened on Friday after the May jobs report showed slightly stronger-than-expected employment growth, although private employment, jobless claims and services data pointed to some weakness in the economy.

The Japanese yen appreciated 0.2% to ¥144.60 per US dollar on Monday, rebounding after two consecutive days of losses, as revised data showed the country’s first-quarter GDP was flat, an improvement from the previously estimated 0.2% contraction. Despite the upward revision, the result still reflects a sharp deceleration from the 0.6% growth recorded in the prior quarter. Separately, Japan’s current account surplus narrowed in April and fell short of market expectations, adding a mixed note to the economic outlook. Last week, Bank of Japan Governor Kazuo Ueda reaffirmed the central bank’s readiness to raise interest rates if economic and inflation forecasts are met, reinforcing the view of a gradual but steady tightening path.

The offshore yuan strengthened 0.1% to around Rmb 7.18 per dollar on Monday, ending two consecutive sessions of losses, supported by a potential easing of US-China trade tensions despite deepening deflationary concerns. Consumer prices on the mainland fell for a fourth straight month and producer prices saw their steepest drop in nearly two years, underscoring persistent deflationary pressures and Beijing’s limited success in reviving domestic demand. The data strengthens the case for further monetary easing.

Gold Steady Ahead Of US-China Trade Talks

Gold prices were steady on Monday, following a two-day decline, as markets awaited details from the latest round of US-China trade talks. Spot gold was 0.5% higher at $3,327 per troy ounce.

Oil Holds Weekly Gains

Brent crude oil futures traded 0.9% higher at $67.10 per barrel on Monday, the highest level in seven weeks. Oil surged 4% last week, driven by renewed optimism over US-China negotiations. Additionally, Friday’s US jobs report for May showed underlying resilience in the job market, alleviating fears about an economic slowdown that would dampen demand.

Bitcoin Surges

Bitcoin surged 4.2% over the past 24 hours trading close to $109,000 at one stage before ending the day at $108,770.

Peter Lewis’ Money Talk Podcast

On Tuesday’s “Peter Lewis’ Money Talk” podcast, I’ll be joined by Mark Michelson, Chairman of the Asia CEO Forum at IMA Asia, Will Denyer, US Economist at Gavekal, and in Washington D.C., our US Economics Correspondent, writer & broadcaster, Barry Wood.

The podcast is also available on Apple Podcasts, YouTube Studio and Spotify.

Spotify

YouTube Studio

https://www.youtube.com/playlist?list=PLnwqOJD9ie5gHH29bNfuG1Nscy8rdJo6O

Apple Podcasts

This podcast is sponsored by Surfin Group, which is headquartered in Singapore and offers online financial services to 60 million customers across 10 countries. You can find out more about them by going to their website www.surfin.sg