PETER’S BUSINESS & FINANCE BRIEFING – Tuesday 01 April 2025, 06:00 Hong Kong

● Trump’s reciprocal tariffs set to arrive April 2 ● Trump considering “secondary tariffs” on Russian oil ● Asia-Pacific markets slump as tariffs loom

Tuesday’s Opening Call

Hang Seng (Hong Kong) Projected Open: 23,214 +94 points +0.4%

Nikkei 225 (Japan) Projected Open: 35,950 +332 points +0.9%

Quick Summary - 4 Things To Know Before Asian Markets Open

This week is a key one in the trade war, as reciprocal tariffs on imports to the US and also a 25% levy on autos, are set to take effect on April 2, dubbed USA “Liberation Day” by Donald Trump. The US president has vowed to impose “substantial” tariffs on the US’s trading partners, even as he suggested he may “give a lot of countries breaks”. The latest levies will raise the US effective tariff rate to above 15%, a level not seen since the Great Depression era. When Trump took office the effective tariff rate was 3%.

Donald Trump has threatened to impose secondary tariffs on countries that buy Russia’s oil if the country thwarted cease-fire negotiations with Ukraine. The biggest such buyers by a long margin are China and India. Trump did not offer a clear explanation of what the plan would involve. He said, “anybody buying oil from Russia will not be able to sell their product, any product, not just oil, into the United States”, but also said there would be a “25 to 50-point tariff on all oil”. Trump said Sunday he was “pissed off” with Vladimir Putin for dragging his feet in talks over a ceasefire with Ukraine.

South Korea, China and Japan held their first economic dialogue in five years on Sunday in Seoul, seeking to facilitate regional trade as the three Asian export powers brace from Donald Trump’s tariffs. The countries’ three trade ministers agreed to “closely cooperate for a comprehensive and high-level” talks on a South Korea-Japan-China free trade agreement deal to promote “regional and global trade”, according to a statement released after the meeting. However, they have not made substantial progress on a trilateral free-trade deal since starting talks in 2012.

China’s official manufacturing purchasing managers’ index (PMI) came in at 50.5 in March, according to the National Bureau of Statistics data released Monday, accelerating from the prior month’s contraction of 49.1 and in line with Reuters poll estimates. Activity expanded at its fastest pace in one year, signalling Beijing’s stimulus measures were helping prop up an economic recovery, while looming US tariffs threaten to thwart growth. The non-manufacturing PMI, which covers services and construction, also rose to 50.8 from 50.4 in February.

Week Ahead - March 31st to April 6th

This week is a key one in the trade war, as reciprocal tariffs on imports to the US and also a 25% levy on autos, are set to take effect on April 2, dubbed USA “Liberation Day” by Donald Trump. On the economic front, the US jobs report will be closely scrutinised, alongside the ISM PMIs, which will provide insights into the labour market and private sector performance.

In the Asia-Pacific region, the Reserve Bank of Australia is meeting today and is expected to keep interest rates unchanged. In China, there will be official and Caixin PMIs. The Caixin/S&P Global manufacturing PMI for March, due today, is forecast to show manufacturing activity picking up to 51.1 from 50.8 in the prior month. That follows official data released yesterday which showed factory activity expanding at the fastest pace in a year.

Japan's Tankan business survey and PMIs will also be in focus. Moody’s Analytics wrote in a note Monday, “Japanese data coming out this week will highlight the subdued state of the domestic economy and the challenges facing manufacturers from the deteriorating trade environment. With the threat of US tariffs looming over Japanese imports, manufacturers face significant headwinds. Eyes will be on the Bank of Japan’s Tankan survey for signs of deteriorating business sentiment. We expect the Tankan overall diffusion index to slip to 13 in March from 15 in December.”

There will also be consumer price inflation data released this week for South Korea, Philippines and Thailand. The HSBC March manufacturing PMI data for India will be released on Wednesday followed by the Services PMI on Friday.

On the geopolitical front, Chinese foreign minister Wang Yi visits Russia for talks on issues including the Ukraine war. The EU-Central Asia Summit, the first between the EU and leaders from Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, kicks off on Thursday in Uzbekistan.

Elsewhere, there will be preliminary inflation figures for the Eurozone, and Germany's factory orders will be in focus. The PMIs for Europe's largest economies will also be closely watched. The European Central Bank publishes the last monetary policy meeting minutes on Thursday.

On the corporate front, Microsoft will celebrate turning 50 at its Seattle headquarters on Friday. Special appearances are expected from key figures in the company’s history, such as co-founder Bill Gates and former chief executive Steve Ballmer.

On Sunday, Washington’s TikTok ban will come into force, with its owner, Chinese internet company ByteDance, required to either shut the app down or sell it. “We have a lot of potential buyers,” Trump told reporters on Air Force One Monday. “There’s tremendous interest in TikTok,” adding, “I’d like to see TikTok remain alive.”

Businesses & Investors Await USA “Liberation Day”

The US president has named Wednesday as the date that he’ll begin secondary tariffs on top of the levies already announced to punish exporters of aluminium, steel, cars and fentanyl to America. Analysts at Barclays said Trump's reciprocal tariffs on Wednesday may impact as many as 25 countries. This could be the largest wave of tariffs in a single day in US history.

Donald Trump calls it “Liberation Day”, though many specifics remain unclear. Trump has vowed to impose “substantial” tariffs on the US’s trading partners and had previously suggested he may “give a lot of countries breaks”. But then on Sunday, Trump said he plans to start his reciprocal tariff push with “all countries,” dampening down speculation he might limit the initial scope. “They’ve charged us so much that I’m embarrassed to charge them what they’ve charged us, but it’ll be substantial,” he said, hours after announcing new tariffs on buyers of Venezuelan oil, which includes China.

On Sunday, Trump said he “couldn’t care less” if automakers hike prices because he expects buyers will switch to American-made cars. Trump was asked whether he warned automaker chief executives not to raise consumer prices in response to the 25% tariffs he plans to impose on some of their products next week. “No, I never said that,” Trump said. “I hope they raise their prices, because if they do, people are going to buy American-made cars,” he said. Trump trade adviser Peter Navarro predicts the tariffs won't mean higher prices, saying foreigners will "eat most of it", and that it's the "biggest tax cut in American history for the middle class".

The latest mixed messages from the US president reflect a continued debate within his administration over exactly how Trump will enforce his new tariff regime, and to what end. Some media reports said Trump is considering a two-step approach to his new tariff regime, deploying rarely used powers to impose emergency duties while probes into trading partners are completed.

The FT economics leader writer Tej Parikh puts the case that many of the risks are on the US economy since it is not as important to globalisation as some think. America accounts for just 13% of global goods imports, down from almost a fifth two decades ago, Parikh notes. Moreover, research from Simon Evenett, professor at the IMD Business School, found that even if the US cut off all goods imports, 70 of its trading partners would fully make up their lost sales to the US within a year, and 115 would do so within five years, assuming they maintained their current export growth rates to other markets. Mark Malek, chief investment officer at Siebert said, everything is at stake, everything. Inflation is on the rise, consumption is showing signs of weakness, consumer sentiment is slipping, all stemming from the administration’s tariff policy.”

David Roche, President & Global Strategist at Quantum Strategy, wrote in a note Sunday, “US ‘remedial’ tariffs to be announced on April 2 will raise the US effective tariff rate to above 15% - a level not seen since the Great Depression era. [When Trump took office the effective tariff rate was 3%.] This is above the level needed to cause Tariff-Induced-Stagflation in the US economy. The announcement will confirm a bear market in most assets hit by lower profits and higher inflation. But the significance is far wider. Liberation Day will mark an acceleration of the process of substituting “nationalist economics” for “globalisation”. It cannot happen in the US without doing so globally. That is the price of a protectionist world. This lowers growth and productivity and raises inflation in a secular shift.”

Roche also notes that “attempts by non-US governments to separate trade from geopolitics are becoming unsustainable. It is hard to inflict punitive tariffs on an ally’s exports while still claiming to be an ally. The US has effectively integrated economics and diplomacy into a single nationalist, geo-economic weapon; US alliances are now paid services. Security and Economic Policies are increasingly aligned. Henceforth, economic and geopolitical frictions will act as interactive multipliers; the escalation ladder has become an upward moving escalator.

Trump Threatens Tariffs On Russian Oil

Donald Trump has threatened to impose secondary tariffs on countries that buy Russia’s oil if the country thwarted cease-fire negotiations with Ukraine. The biggest such buyers by a long margin are China and India. Trump did not offer a clear explanation of what the plan would involve. He said, “anybody buying oil from Russia will not be able to sell their product, any product, not just oil, into the United States”, but also said there would be a “25 to 50-point tariff on all oil”.

Trump said Sunday he was “pissed off” with Vladimir Putin for dragging his feet in talks over a ceasefire with Ukraine. "If Russia and I are unable to make a deal on stopping the bloodshed in Ukraine, and if I think it was Russia's fault, which it might not be, I am going to put secondary tariffs. on all oil coming out of Russia," he said. Trump’s outburst at Moscow marks the first time he has seriously threatened Russia with consequences for dragging its feet in Ukraine ceasefire negotiations. For weeks, he blamed Volodymyr Zelensky, the Ukrainian president, for being reluctant to strike a deal and demanded numerous concessions from Ukraine. In turn, he has flattered Putin and largely given in to the Russian president's demands. But on Sunday, he told NBC News, “I was very angry when Putin started getting into Zelenskyy’s credibility. That’s not going in the right location, you understand?” New leadership means you're not gonna have a deal for a long time.”

Zelensky wrote on social media following the interview that "Russia continues looking for excuses to drag this war out even further". He said that "Putin is playing the same game he has since 2014", when Russia unilaterally annexed the Crimean Peninsula. "This is dangerous for everyone and there should be an appropriate response from the United States, Europe, and all our global partners who seek peace."

Trump Says He Is ‘Not Joking’ About Seeking A Third Term In Office

Donald Trump said he was “not joking” about serving a third term, adding that there were “methods” by which he could bypass the constitutional prohibition on US presidents being elected three times. In a phone interview with NBC News on Sunday, Trump said “it is far too early to think about it” but confirmed that he was entertaining the possibility. “A lot of people want me to do it,” said Trump, 78. “I basically tell them we have a long way to go, you know, it’s very early in the administration.”

The 22nd amendment to the US Constitution states, “no person shall be elected to the office of the President more than twice.” But Trump replied, “there are methods which you could do it.” It would take a two-thirds vote in Congress or a constitutional convention called by two-thirds of the states to allow Trump to run for a third term.

US Imposes Sanctions On Chinese & Hong Kong Security Officials

The US has imposed sanctions on senior Chinese and Hong Kong security officials for transnational repression and degrading the autonomy of the territory, in a significant move against Beijing by the Trump administration. Washington placed the sanctions on six officials, including the commissioner of the Hong Kong police force, in response to China’s crackdown on pro-democracy activists in the territory. Officials in Beijing and Hong Kong “have used Hong Kong national security laws extraterritorially to intimidate, silence, and harass 19 pro-democracy activists who were forced to flee overseas, including a US citizen and four other US residents”, the state department said on Monday. Secretary of state Marco Rubio said in a statement that the six were being penalised for “their role as leaders or officials of the Hong Kong government that have engaged in actions or policies that have degraded the autonomy of Hong Kong, including in connection with transnational repression targeting individuals residing in the United States”, and for their roles in developing and implementing the territory’s tough national security law. The individuals targeted by the US are all security or police officials, including Dong Jingwei, a senior figure in China’s Ministry of State Security, the country’s primary civilian intelligence organisation, and Raymond Siu, commissioner of Hong Kong’s police force. The others are Sonny Au, Dick Wong, Margaret Chiu and Paul Lam.

Xi To Visit Vietnam, Malaysia & Cambodia In April

President Xi Jinping will visit Vietnam, Malaysia, and Cambodia on his first overseas trip this year, likely starting in mid-April, the South China Morning Post Reported Monday. The visit comes as Beijing seeks to strengthen ties with regional partners amid the US-China trade war, with Vietnam and Malaysia exposed to higher tariffs. Xi's visit to Cambodia will follow the inauguration of a naval port supported by Beijing, which the US fears could become China's first outpost in the Indo-Pacific.

Australia’s Albanese Takes Lead In Polls As Election Race Starts

A Newspoll survey released by The Australian newspaper on Sunday found that Prime Minister Anthony Albanese's government has pulled ahead of the Liberal-National opposition by 51% to 49%, its strongest result in nine months. The government has been languishing in the polls for months due to a cost-of-living crisis, but the polls have begun to turn in Albanese's favour following the first easing by the Reserve Bank in February. Albanese is fighting to become the first Australian leader in more than two decades to win consecutive terms in office, with a slim majority of just a handful of seats. Polls by Resolve, YouGov and Redbridge found similar results in surveys published in recent days, the first tranche of polling released since Albanese kicked off a five-week election campaign on Friday.

In a budget released last week, Treasurer Jim Chalmers announced surprise tax cuts for every voter, reducing the lowest tax bracket to 14% by 2027. The Coalition has said they would wind that back if they win power and instead cut the fuel excise. On Sunday, Albanese said he would ban price gouging by supermarkets if re-elected at the May 3 vote.

Myanmar Rebels Call For Ceasefire As Quake Death Toll Rises

Myanmar’s rebels declared a two-week ceasefire in quake-hit areas as the death toll, including those in Thailand, reached about 1,700. Around 3,400 people are injured and almost 300 are missing after Friday’s 7.7-magnitude earthquake. The temporary ceasefire may ease rescue efforts in Myanmar, which has been under the control of a military junta since 2021. The United States Geological Survey said the highest probability is that more than 10,000 people may have died and warned that estimated economic losses may exceed the Southeast Asian nation’s GDP. A separate 7-magnitude quake struck near Tonga early Monday, briefly triggering a tsunami warning.

The Association of Southeast Asia Nations also convened a virtual emergency meeting on Sunday to propose expanding its assistance to the affected countries. Thai Foreign Minister Maris Sangiampongsa said in a post on X that he and his Malaysian counterpart will visit Myanmar on April 5 to further discuss humanitarian needs.

Pete Hegseth Says US Is Setting Up A ‘War-Fighting’ Base In Japan

US defence secretary Pete Hegseth said America had begun upgrading its military forces in Japan to set up a “war-fighting” headquarters, as the allies attempt to build a more formidable deterrence against China. The upgrade, the first phase of a reorganisation of US forces in Japan announced under the Biden administration, would improve their ability to coordinate operations with Japan’s Self-Defence Forces and “keep the enemy guessing” by creating strategic dilemmas in the region, Hegseth said on Sunday. “Peace through strength with America in the lead is back,” he added. Trump earlier this month described the US-Japan treaty as “an interesting deal with Japan that we have to protect them, but they don’t have to protect us”, comments that raised fears among Japanese officials.

However, Hegseth said the US-Japan military alliance remained the cornerstone of peace and security in the Indo-Pacific region. “President Trump has also made it very clear we’re going to put America first. But America First does not mean America alone,” he said. “America’s warriors stand shoulder to shoulder every day with their Japan self-defence Force counterparts.” Hegseth made similar assurances on a visit to the Philippines on Friday, where he reaffirmed Washington’s “ironclad alliance” with Manila to strengthen deterrence in the Pacific.

Japan’s defence minister Gen Nakatani and Hegseth said that their 85-minute summit had not included discussion of specific military spending targets for Japan. Nakatani said that Japan was making efforts to “drastically strengthen” the country’s defence capabilities but added that he had emphasised to Hegseth that it was important for Japan to proceed “at its own discretion”.

Hegseth said that both the US and Japan had to recognise that they needed to do more to present a credible deterrence to China. “Our job at the defence department with our friends on the military side is to build an alliance so robust that both the reality and the perception of deterrence is real and ongoing so that the Communist Chinese don’t take the aggressive actions that some have contemplated they will,” said Hegseth.

South Korea, China & Japan Agree To Promote Regional Trade

South Korea, China and Japan held their first economic dialogue in five years on Sunday in Seoul, seeking to facilitate regional trade as the three Asian export powers brace from Donald Trump’s tariffs. The countries’ three trade ministers agreed to “closely cooperate for a comprehensive and high-level” talks on a South Korea-Japan-China free trade agreement deal to promote “regional and global trade”, according to a statement released after the meeting. “It is necessary to strengthen the implementation of RCEP, in which all three countries have participated, and to create a framework for expanding trade cooperation among the three countries through Korea-China-Japan FTA negotiations,” said South Korean Trade Minister Ahn Duk-geun, referring to the Regional Comprehensive Economic Partnership. However, they have not made substantial progress on a trilateral free-trade deal since starting talks in 2012.

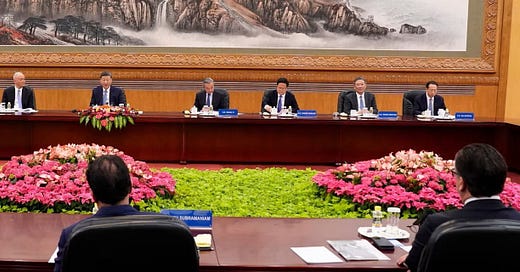

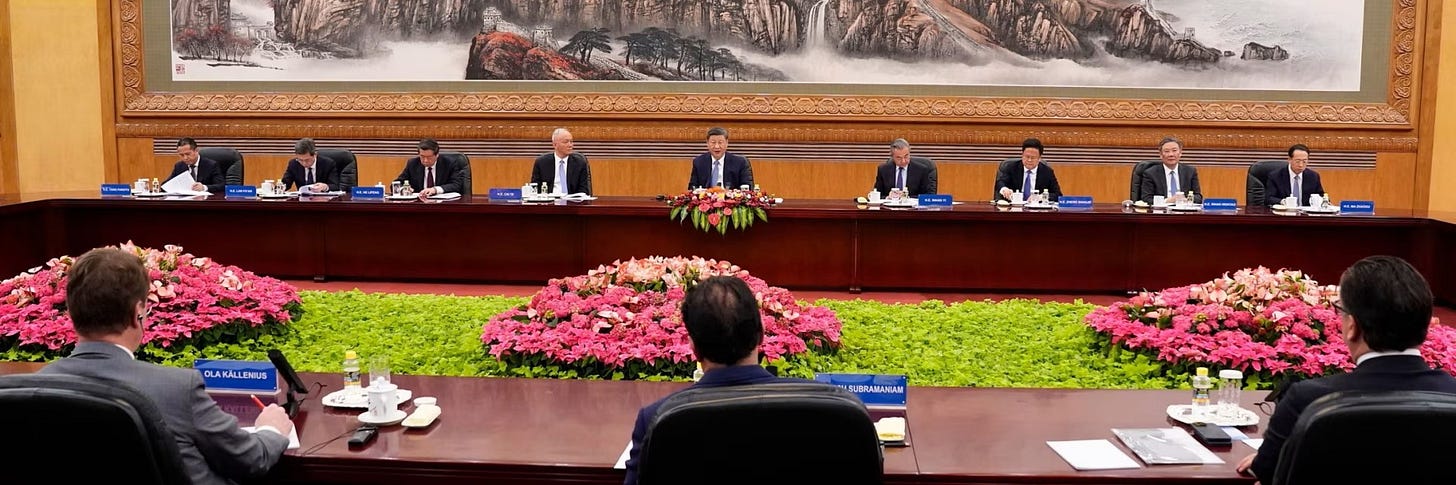

Xi Jinping Pitches China To Global CEOs As Protector Of Trade

In a meeting with foreign business leaders on Friday, President Xi Jinping cast Beijing as a force of stability for international business amid Trump’s trade wars. Business leaders Xi met included Bridgewater Associates’ Ray Dalio, Standard Chartered CEO Bill Winters and Blackstone Group CEO Steve Schwartzman. “To invest in China is to invest in tomorrow,” Xi said as he emphasized that the country was a safe and stable place for companies. “Some countries are building a small yard with high fences, erecting tariff barriers, politicizing business issues, using them as tools and weapons,” Xi said at the Great Hall of the People, without naming any nation. “I hope you will share your sensible views and take actions to push back against the retrogressive rules and the zero-sum games,” he said.

Xi’s remarks are part of a campaign to court investors as slowing growth and mounting geopolitical tensions hurt the draw of the world’s second-largest economy, with inbound investment tumbling last year to its lowest in over three decades. He promised to improve market access and address their challenges of operating in the country. “We are providing a transparent, steady and predictable policy environment,” Xi said, calling the nation a “favourite destination” for foreign investors. “Embracing China is embracing opportunities.” Echoing recent policy plans, Xi said that China would ensure fair opportunities for foreign businesses to participate in government procurement bids.

Politburo standing committee member Cai Qi, China’s top diplomat Wang Yi and Vice Premier He Lifeng also attended the meeting along with the heads of China’s economic planning agency, finance ministry and commerce ministry. Seven foreign executives spoke at the event, including Aramco’s Amin H. Nasser, who pledged to expand investment in chemical production in China and praised the country for “becoming an oasis of certainty.”

Unlike in 2024, Xi invited reporters into the room when he gave a closing statement. Xi didn’t disclose in his public remarks specific new measures to benefit foreign investors in the country, who have long complained of unfair competition and policies that favor Chinese companies. Michael Hart, president of the American Chamber of Commerce in China, said foreign companies maintain significant interest to operate in China, but worsening trade tensions are giving some pause. “Barriers still remain, and companies fear tit-for-tat actions because of the trade war,” Hart said. “China needs to deliver for companies who have already met them at least halfway.”

Beijing To Launch Antitrust Probe Into Panama Ports Deal

Hong Kong tycoon Li Ka-shing’s CK Hutchison Holdings will not go ahead with the expected signing of a deal this week to sell its two ports at the Panama Canal, as Beijing revealed it will launch an antitrust probe into the sale. The State Administration for Market Regulation said on Friday it was looking into the deal. The regulators are also reviewing what investments the family has in China and abroad in a bid to better understand the breadth of their business dealings.

The sale of CK Hutchison’s two ports at each end of the Panama Canal was part of a US$23 billion deal to sell 43 ports spread over 23 countries to a consortium led by United States investment firm BlackRock. The ports sale, which is expected to net CK Hutchison more than US$19 billion in cash proceeds, triggered scrutiny in Beijing after Donald Trump hailed it as the US reclaiming the strategic waterway from Chinese influence. China is looking into the sale for potential national security and antitrust violations. However, it’s uncertain how much leverage Beijing has, given that Chinese and Hong Kong ports are not included in the transaction.

A local deputy to the National People’s Congress and chairman of the Federation of Trade Unions, Stanley Ng, said anything irregular that’s discovered in the review should be halted immediately. Ng further stressed that influential businessmen here must have a sense of national security and consider matters from the perspective of the nation.

Beijing Launches $72bn Capital Injections At Biggest Banks

Four of China’s biggest banks will raise a combined Rmb520bn (US$72bn) through share sales to investors including the Ministry of Finance, as Beijing seeks to shore up its vast banking sector against pressing economic woes. The rare government-directed injections are part of a series of official support measures that have since last September aimed to restore confidence in the world’s second-largest economy. The Ministry of Finance will be a major investor in the capital raise by the four banks, which are all state-owned and collectively had about Rmb10tn in capital as of last June. The rare government-directed injections will increase the banks’ core tier one capital, a gauge of equity that regulators use to limit leverage and are part of a series of official support measures that have since last September aimed to restore confidence in the world’s second-largest economy.

The country’s biggest banks face margin pressure and the capital increase, which was previously flagged by authorities, is part of a push to boost lending amid continued weakness across an economically critical property sector. “The injections would boost the availability of funds to support the country’s growth amid tariff headwinds,” wrote analysts at S&P Global this month. They added that the “megabanks play an important role in supporting the government’s social and economic initiatives via lending to policy promoted areas”. Moody’s Ratings said Monday, “the plans, if approved by shareholders' and the banking regulator, will be credit positive for the four banks. The capital injection will strengthen the banks' capital in the face of weak profitability, which in China's low-interest rate environment, has come under pressure from narrowing net interest margins.”

Only 0.6% Of Offshore Debt Recovered From China Developers

International bondholders have recovered less than 1% of nearly US$150bn of bonds defaulted on by China’s property developers since 2021, despite years of negotiations and nearly a dozen restructuring agreements. Just US$917mn in cash has been transferred to investors in offshore bonds across 62 developers in that period, according to an analysis of restructuring data from Debtwire, equivalent to 0.6% of the US$147bn in defaults recorded. Only three developers, China Fortune Land Development, China South City and RiseSun Real Estate Development, have made any cash coupon payments across 11 restructuring agreements for US$39bn in debt, as mainland property businesses struggle to generate income. The data highlights the difficulties for international investors in recovering money from any of their holdings in Chinese developers, which borrowed heavily on overseas markets during a boom that unravelled following the default of Evergrande in 2021.

Huawei 2024 Revenue Surges To Near Record High

Huawei on Monday reported a sharp jump in 2024 revenue as its core telecommunications and consumer businesses accelerated. Huawei reported revenue for 2024 of 862.1 billion Chinese yuan (US$118.2bn), a 22.4% year-on-year rise. It is the company’s second-highest revenue figure ever, just shy of the record 891.4 billion yuan reported for 2020. The consumer business reported sales of 339 billion yuan (US$46.7bn), a 38.3% rise and a sharp acceleration from the growth seen last year, as China smartphone sales boosted the business. Net profit fell, however, to 62.6 billion yuan, a decline of 28% versus 2023. Huawei said this was a result of increasing investments. Huawei has been trying to adapt its business to deal with US sanctions that have restricted its access to key technologies like semiconductors.

Japan’s February Factory Output Growth Tops Expectations

Japan’s factory output rose 2.5% m/m in February, reversing a decline in the previous month, data from the Ministry of Economy, Trade and Industry data showed on Monday. This was higher than the 2.3% rise estimated by Reuters, with output driven by production machinery and electronics parts. On an annual basis, industrial production grew 0.3%, slowing from January’s 2.2% gain.

Separately, data released Monday showed a 1.4% rise in Japan’s retail sales in February from a year earlier. The reading was less than the 2% rise forecast by Reuters and the 4.4% increase seen in January. On a monthly basis, retail sales climbed by 0.5% in February, the same as in January.

South Korea Retail Sales Rise To 6-Month High In February

South Korea’s retail sales rose 1.5% on a seasonally adjusted basis in February, government data released Monday showed. That is the highest reading since August 2024 and follows a 0.7% fall in the previous month.

Meanwhile, South Korea’s industrial production jumped 7% year-on-year in February, faster than the 2% expected by economists polled by Reuters, after falling 4.7% in the previous month. On a seasonally adjusted basis, the country’s factory output rose 1% in February from the month earlier, data released by Statistics Korea on Monday showed. This follows a 2.8% expansion in January and an increase of 0.8% expected by analysts in a Reuters poll.

China’s Factory Activity Expands At Fastest Pace In A Year

China’s official manufacturing purchasing managers’ index (PMI) came in at 50.5 in March, according to the National Bureau of Statistics data released Monday, accelerating from the prior month’s contraction of 49.1 and in line with Reuters poll estimates. Activity expanded at its fastest pace in one year, signalling Beijing’s stimulus measures were helping prop up an economic recovery, while looming US tariffs threaten to thwart growth. The non-manufacturing PMI, which covers services and construction, also rose to 50.8 from 50.4 in February.

The latest PMI figure has added to a mixed bag of economic data at the start of the year that showed industrial output and fixed asset investment grew more than expected, while consumer inflation fell into negative territory for the first time in a year. Exports, a lone bright spot in the faltering economy, have lost momentum in the first two months of the year, growing at their slowest rate since April last year, according to LSEG data, as exporters’ front-loading activity to get ahead of new tariffs started to taper off. Chinese policymakers have pledged to step up monetary and fiscal stimulus to achieve a growth target of “around 5%” this year and cushion the impact of an escalating trade war with the US.

Hong Kong Retail Sales Slump In February

Retail sales in Hong Kong declined 15% year-on-year in February, slipping further from a downwardly revised 5.1% drop in January. This marked the twelfth straight month of falling retail activity and the sharpest drop since April 2024, dragged by lower sales in all product categories. On a monthly basis, retail sales plunged 17.3% in February, reversing an upwardly revised 8.2% growth in January. A government spokesman noted that the retail sector would continue to face challenges from changes in consumption patterns among visitors and residents.

German Inflation Falls In March

German inflation came in at 2.3% in March, preliminary data from the country’s statistics office Destatis showed Monday. Economists polled by Reuters had forecast a 2.4% annual reading. It compares to February’s 2.6% print, which was revised lower from a preliminary reading. The print is harmonized across the euro area for comparability. On a monthly basis, harmonized inflation rose 0.4%. Core inflation, which excludes food and energy costs, came in at 2.5%, below February’s 2.7% reading. Meanwhile services inflation, which had long been sticky, also eased to 3.4% in March, from 3.8% in the previous month.

Monday’s inflation figures out of Germany, paired with recent data from other major eurozone countries such as Spain and France, suggests that eurozone headline inflation will likely have eased in March, Franziska Palmas, senior Europe economist at Capital Economics, suggested in a note. Eurozone inflation figures are due today. Economists polled by Reuters were last forecasting the reading to come in at 2.3%. Markets were last pricing in an around 91% chance of a 25 bps interest rate cut from the ECB on April 17.

US Inflation Fears Worsen

The University of Michigan’s final read on consumer sentiment for March reflected the highest long-term inflation expectations since 1993. The reading of current sentiment came in at 57, slightly below a Dow Jones estimate of 57.9, as inflation expectations reached multi-decade highs. “Long-run inflation expectations surged from 3.5% in February to 4.1% in March, reflecting a large surge among independents plus a sizable rise among Republicans,” Surveys of Consumers director Joanne Hsu wrote. Expectations have not been that high since early 1993. “This month’s decline reflects a clear consensus across all demographic and political affiliations; Republicans joined independents and Democrats in expressing worsening expectations since February for their personal finances, business conditions, unemployment, and inflation,” Hsu said. Short term inflation expectations also rose. Respondents expect inflation a year from now to run at a 5% rate, up 0.1 percentage point from the mid-month reading, and a 0.7 percentage point acceleration from February. In addition to worries about the current state of affairs, the survey’s index of consumer expectations tumbled to 52.6, down 17.8% from a month ago and 32% for the same period in 2024. The latest results also reflect worries over the labour market, with the level of consumers expecting the unemployment rate to rise at the highest level since 2009.

Friday’s core personal consumption expenditures price index also came out hotter-than-expected, rising 2.8% in February and reflecting a 0.4% increase for the month, the biggest move since January 2024, stoking concerns about persistent inflation. Economists surveyed by Dow Jones had been looking for respective numbers of 2.7% and 0.3%. Core inflation excludes volatile food and energy prices and is generally considered a better indicator of long-term inflation trends. In the all-items measure, the price index rose 0.3% on the month and 2.5% from a year ago, both in line with forecasts.

Consumer spending accelerated 0.4% for the month, below the 0.5% forecast, according to fresh data from the Bureau of Economic Analysis. That came as personal income posted a 0.8% rise, against the estimate for 0.4%.

“It looks like a ‘wait-and-see’ Fed still has more waiting to do,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “Today’s higher-than-expected inflation reading wasn’t exceptionally hot, but it isn’t going to speed up the Fed’s timeline for cutting interest rates, especially given the uncertainty surrounding tariffs.” The report comes with markets on edge that President Donald Trump’s tariff intentions will aggravate inflation at a time when the data was making slow but steady progress back to the Fed’s 2% goal. “The market is getting squeezed by both sides. There is uncertainty around this week’s reciprocal tariffs hitting the major exporting sectors like tech alongside concerns about a weakening consumer facing higher prices hitting areas like discretionary,” said Scott Helfstein, head of investment strategy at Global X.

Asia-Pacific Markets Slump As Tariffs Loom

Asia-Pacific markets plunged Monday ahead of Donald Trump’s fresh round of tariffs expected later in the week. Trump said Sunday, “every single country in Asia” had engaged in “unfair” trade practices towards the US. Traders also reacted to sharp falls on Wall Street Friday which saw the S&P 500 shed 2.0%, ending the week down for the fifth time in the last six weeks. The Nasdaq Composite slumped 2.7%.

Japan’s benchmark Nikkei 225 closed down 4.1% at 35,618, after having plunged 4.3% earlier in the session to a six-month low, in its biggest intraday decline since September. The Nikkei fell below 36,000 for the first time since March 11 and has declined more than 10% since the end of December, putting it in correction territory.

In South Korea, the Kospi index fell 2.6% adding to its losses from last week and hitting its lowest level in nearly two months. The Kospi has held on to its gains for the first quarter of 2025, rising 3.4%. Taiwan’s benchmark Taiex tumbled 4.2% to enter correction territory, down almost 12% from its recent peak reached on 21 February. Australia’s S&P/ASX 200 closed 1.7% lower, taking its losses for the first quarter to 3.9%. Australia’s central bank is likely to keep its key rate on hold today amid a tight national election.

Chipmakers from the region were among the biggest losers, with Taiwan Semiconductor Manufacturing Company tumbling 4.4% and Samsung Electronics dropping 4.4%. Japan’s Disco, a maker of tools for chip production, declined 8.4%. Renesas Electronics plunged 11.2% and Socionext tumbled 8.8% in Tokyo.

South Korea on Monday lifted the longest short-selling ban in the country’s history, after tightening measures to crackdown on illegal transactions. The short-selling ban was put into place in November 2023 following a series of short-selling breaches that involved numerous global investment banks. Beginning yesterday, short selling on the estimated 2,700 stocks listed on the Korea Exchange will be fully reinstated, according to the country’s Financial Services Commission. Previously, it was only allowed for 350 stocks on the benchmark Kospi and small-cap Kosdaq.

Thai authorities sought to calm investor nerves as the stock exchange resumed trading after a massive earthquake on Friday caused widespread damage to buildings and killed about 18 people. The overall fundamentals of companies listed on the Thai stock exchange remain strong, Asadej Kongsiri, president of the Stock Exchange of Thailand, told a briefing held along with representatives of the Bank of Thailand and the Securities and Exchange Commission among others. The business sector can cope with the post-quake situation and continue business without affecting the competitiveness of listed companies, Adaj said. The SET Index ended the day 1.4% lower.

Chinese Stocks Outperform

Chinese stocks also fell Monday in response to Trump’s tariff threats but they outperformed the rest of the region. Hong Kong’s Hang Seng Index dropped 307 points, or 1.3%, to 23,120. Still, for the first quarter, the HSI rose 15.3%, making it one of the world’s best performing markets over the past three months. Tech stocks listed in Hong Kong fell into correction territory Monday. The Tech Index dropped 2.0%, taking its decline to almost 12% since its March 17 high. Investor inflow pushed the Hang Seng Tech Index to a three-year high earlier this month. Hong Kong stocks, particularly Alibaba and Tencent, saw net purchases from mainland Chinese investors hit a record high recently. Tencent fell 2.5% and Alibaba slipped 2.3% Monday.

“Many investors are waiting for actual tariffs to be announced, unwinding their positions and realising gains,” said Wei Li, head of multi-asset strategy for China at BNP Paribas Asset Management. “This tariff announcement has affected the whole market sentiment.” “There is no specific bad news for China tech stocks, so the recent correction is largely due to profit taking and the relatively subdued China recovery,” said Vincent Chan, Aletheia Capital’s China strategist.

CK Hutchison Holdings, the conglomerate controlled by the Li Ka-shing family, sank 3/1% after Beijing revealed it will launch an antitrust probe into the sale of its two Panama ports. The company also said it was evaluating a plan to spin off its global telecoms business.

Mainland China’s CSI 300 ended the day 0.7% lower at 3,887. For the first quarter, the CSI 300 was down 1.2%. The latest PMI figures signalled that Beijing’s stimulus measures are supporting economic recovery, though weak domestic consumption and global trade tensions remain key risks.

Sales at one of China’s largest property developers fell by more than a third last year as the country’s real estate market struggled to emerge from a slowdown now in its fourth year. Revenues at Country Garden fell 37% to Rmb253bn (US$35bn), the biggest annual drop for the group since a nationwide property crisis began in 2021 with the collapse of developer Evergrande. Country Garden narrowed its loss to Rmb32.8bn after a record Rmb178bn in 2023, which was driven by a series of writedowns. Shares of Country Garden were unchanged in Hong Kong.

Angang Steel, the listed arm of China’s second-biggest steelmaker, racked up a loss of nearly US$1 billion last year, underscoring torrid conditions in the industry as demand shrinks and prices plunge. The company’s annual net loss more than doubled to 7.1 billion yuan (US$981 million) from 3.3 billion yuan in 2023, Angang said in an exchange filing. Steelmakers in China are grappling with the end of a two-decade boom as the country’s property crisis crushes demand. “In 2024, the steel industry faced a further intensification of its weak market conditions,” the company said. Industrial profits for the first two months of 2025 show conditions remain bleak as new growth areas aren’t enough to replace softening construction activity. Mills in China are still pumping out too much steel, with output staying stubbornly above 1 billion tons last year. Shares of Angang Steel fell 5.2% in Hong Kong.

European Equities Outperform US In Q1

European markets followed Asia lower on Monday as global investors braced for Donald Trump’s trade tariffs to come into force. The regional Stoxx 600 index closed 1.5% lower after recovering some ground later in the day. The Stoxx 600 notched its first losing month of the year, with a loss of 4.2%. However, in 2025 so far the index continues to outperform the US, with a quarterly gain of 5.2%.

London’s FTSE 100 closed 0.9% lower. The price moves come after British Prime Minister Keir Starmer and US President Donald Trump discussed their respective teams’ “productive negotiations” on a UK-US economic deal during a Sunday evening phone call, according to a statement from Downing Street. The two leaders are said to have agreed that their delegations’ talks on such a deal will “continue at pace this week.” Trump has previously suggested the two countries could reach a “real trade deal” that allows Britain to evade the full force of his tariffs regime.

France’s Cac 40 was 1.6% lower Monday. Marine Le Pen, the far-right leader, was found guilty of embezzlement yesterday and disqualified from running for public office for five years. The verdict could lead to new political turmoil in France. It effectively knocked Le Pen, France’s most popular politician, according to the polls, out of the 2027 presidential election.

Europe’s Stoxx Automobiles and Parts index was 2.6% lower. Volkswagen was down 3.5%, while Mercedes-Benz lost 2.8% and Renault shed 2.0%. Shares of Britain’s Aston Martin jumped 7.1% on Monday after the luxury carmaker said it will raise more than £125 million (US$161.7mn) through funding from Chairman Lawrence Stroll’s investment vehicle. Stroll’s stake in the company is poised to increase to roughly 33% from about 27.7% as part of the transaction.

The Stoxx Basic Resources index meanwhile tumbled 3.3% to its lowest level since December 2020, with mining and metals firms including Anglo American, Glencore, Rio Tinto and Antofagasta all down more than 3%.

Novo Nordisk has fallen back to Earth with the Danish drugmaker down some 28% in March. US prescription data has been lackluster and trial results for new products have disappointed. Its market capitalization, which once topped US$600 billion, has fallen to around US$300 billion.

Germany’s shift from its historic reluctance to borrow to a “whatever it takes” plan for military and infrastructure spending has helped boost 10-year Bund yields to nearly 3% in March, levels last seen in 2023. That has in turn driven up bond yields in other countries, such as France and Italy, thanks to German debt’s role as the de facto benchmark for the Eurozone’s market.

US Stocks Post Worst Quarter Since 2022

US stocks were jittery ahead of President Donald Trump’s “Liberation Day” and his so-called reciprocal tariffs, with investors looking for safe havens. Investors are fretting that Trump’s levies on trading partners will slow economic growth, while also increasing prices. Sentiment among consumers and businesses has also cooled sharply, several recent surveys have shown. Strategists at Goldman Sachs cut their S&P 500 target for a second time this month, citing a higher recession risk and levy-related uncertainty. Goldman at the weekend also raised its forecast for the core personal expenditures price index, the Federal Reserve’s preferred inflation gauge, by 0.5 percentage points to 3.5%, above the February reading of 2.8%. The investment bank also said it now saw a 35% chance of recession over the next year from 20% previously. Sharon Bell, senior equities strategist at Goldman Sachs, said the tariff threat “ups the risk premium that you put on equities”, although she added that the US stock market had “other issues”, including a slowing pace of growth and public sector cuts.

On Monday, US stocks rebounded from sharp losses earlier in the day. The S&P 500 added 0.6% to close at 5,612. At one point, it fell as much as 1.7% and briefly traded at a 6-month low and 10% below its record high, the technical definition of a correction. The Dow advanced 418 points, or 1.0%, to settle at 42,002. The Nasdaq Composite fell 0.1% and closed at 17,299.

Wall Street stocks posted their worst quarter in almost three years on fears that Donald Trump’s tariffs will usher in a period of stagflation in the world’s biggest economy. The S&P 500 dropped 4.6% in the first three months of 2025, the worst performance since the third quarter of 2022. The Nasdaq Composite slid 10.4% in the first quarter. America’s ‘Magnificent Seven’ tech megacaps have fallen into a bear market, having lost more than 20% from Christmas Eve’s record-high close. That’s according to UBS’s Mag7 index, which is fixed to 100 on incorporation in October 2023 and rebalances twice yearly.

Nvidia, which makes high-end chips that are widely used by AI groups to train their models, fell by almost a fifth in the first quarter. Apple and Microsoft shed about 10%. Tesla’s stock plummeted 36% in the first three months of the year, losing over US$460bn in market capitalization. It’s the steepest drop since 2022 and third-biggest decline for any quarter on record. The company has seen declining new vehicle sales and faces concerns surrounding President Trump’s tariffs as well as protests related to CEO Elon Musk’s role in the administration.

Treasury Yields Decline To 4-Week Low

US Treasury yields declined in a sign that investors were piling into safe assets. The yield on the 10-year US Treasury fell 5 bps to a four-week low of 4.21%. The 10-year yield has fallen 36 bps since the start of the year. The 2-year yield was down 3 bps at 3.89% Monday.

US Dollar Weakens

The US dollar Index initially fell below 104 on Monday, amid growing fears over the economic impact of new tariffs, before rebounding with stocks to settle 0.2% higher. Investors are awaiting Friday’s monthly jobs report, which could provide insights into labour market strength and influence expectations for Federal Reserve monetary policy. The US dollar saw its sharpest losses against the safe-haven yen, while also weakening notably against the euro and British pound.

The Japanese yen initially strengthened past ¥149 per dollar in Asian trading on Monday, as investor anxiety over new US tariffs fuelled demand for safe-haven assets but retreated as US stocks recovered to end the New York session almost unchanged at ¥149.93. Hawkish signals from the Bank of Japan also supported the yen. The latest summary of opinions indicated that the central bank would continue raising interest rates if its economic and inflation outlook materializes.

The offshore yuan strengthened 0.2% to around Rmb 7.26 per dollar, as upbeat PMI data boosted market sentiment. Official figures revealed that China’s composite PMI rose to 51.4 in March 2025, up from 51.1 in February, marking its highest level in three months. Adding to the momentum, China plans to inject 500 billion yuan into four major state-owned banks to strengthen its financial sector.

For the month of March, the US Dollar Index lost 3.1% and was down 4.0% over the quarter. By mid-March, speculative traders started betting against the dollar for the first time since Trump’s election amid fear his policy shifts could drive the world’s largest economy into a recession. “It’s unusual and very telling,” said John Sidawi, who helps oversee bond investments at Federated Hermes. “The dollar, in an environment where it should be acting like a safe haven, is not.” The Swedish krona and the Norwegian krone are the best-performing currencies in the G10 group of developed market currencies in the first quarter as investors bet on a higher path for interest rates in Scandinavian countries and a tailwind from the major spending push promised by Germany and other big economies.

Gold Hits Fresh Record

Spot gold rose 1.2% to hit a record $3,124 a troy ounce. The price of the precious metal has been on the rise as investors flock to the safe haven asset amid concerns around Trump’s fresh tariffs. In March, gold was up 9.3% helping it to a 19% gain in the first quarter.

Oil Recovers

Brent crude oil futures recovered from earlier losses to settle 1.5% higher at $74.74 per barrel on Monday after Donald Trump said he could impose secondary tariffs of 25% to 50% on buyers of Russian oil if he feels Moscow is obstructing his efforts to end the Ukraine war. He also warned of additional tariffs and military strikes on Iran if Tehran fails to reach an agreement with the US regarding its nuclear program. The rise was capped by looming OPEC+ production increases and concerns about the impact of US tariffs. The OPEC+ group, led by Saudi Arabia and Russia, is set to begin a gradual output hike in April, with reports suggesting the group will likely continue to raise output in May. For the month, Brent rose 2.1% but is unchanged over the first quarter.

Bitcoin Extends Weak Start To Year

Bitcoin was lower Monday as other cryptocurrencies and crypto related stocks tumbled with the Nasdaq. The price of bitcoin dropped 2% over the past 24 hours to below $83,000 ending the day at $82,575. In March, Bitcoin slid 2.3% and it is down almost 12% in 2025 so far. Bitcoin is expected to face more volatility this month as traders weigh trade policy and await clear growth drivers.

Peter Lewis’ Money Talk Podcast

On Tuesday’s “Peter Lewis’ Money Talk” podcast, I’ll be joined by Mark Michelson, Chairman of the Asia CEO Forum at IMA Asia, Christopher Lee, partner at Farron, Augustine & Alexander Investments, and in Washington D.C., our US Economics Correspondent, Writer & Broadcaster, Barry Wood.

The podcast is also available on Apple Podcasts, YouTube Studio and Spotify.

Spotify

YouTube Studio

https://www.youtube.com/playlist?list=PLnwqOJD9ie5gHH29bNfuG1Nscy8rdJo6O

Apple Podcasts

This podcast is sponsored by Surfin Group, which is headquartered in Singapore and offers online financial services to 60 million customers across 10 countries. You can find out more about them by going to their website www.surfin.sg