PETER’S BUSINESS & FINANCE BRIEFING – Friday 11 July 2025, 06:00 Hong Kong

● Bank of Korea leaves interest rates on hold ● Chinese property shares surge on unverified reports of state aid ● Nvidia to launch new AI chip for China

Friday’s Opening Call

Hang Seng (Hong Kong) Projected Open: 24,114 +86 points +0.4%

Nikkei 225 (Japan) Projected Open: 39,715 +69 points +0.2%

Quick Summary - 4 Things To Know Before Asian Markets Open

South Korea’s central bank left interest rates on hold at 2.5% as expected Thursday, as it assesses the impact of recent measures aimed at cooling Seoul’s housing market. The Bank of Korea (BOK) noted a “significant acceleration in housing prices in Seoul and its surrounding areas, as well as household debt.” Housing prices in Seoul spiked over 19% in June on an annualized basis prompting authorities to step in with measures to address rapidly expanding household loans. The BOK on Thursday said it was critical to evaluate the effect of macro policies given the rise in risks associated with the housing market in Seoul and rising household debt.

The Philippines will hold further trade negotiations with the US after Donald Trump increased the planned tariff rate to 20%. A Philippine delegation led by Frederick Go, special assistant to the president for investment and economic affairs, will meet with US counterparts next week, Go said. He led trade officials during the initial round of talks in May in Washington. Go said the Philippines will aim to convince Washington to lower the rate, which was increased from the 17% announced in April, but cannot offer the US a zero tariff in exchange.

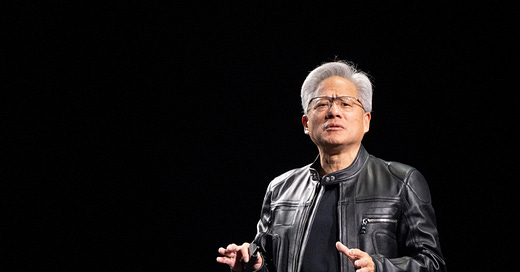

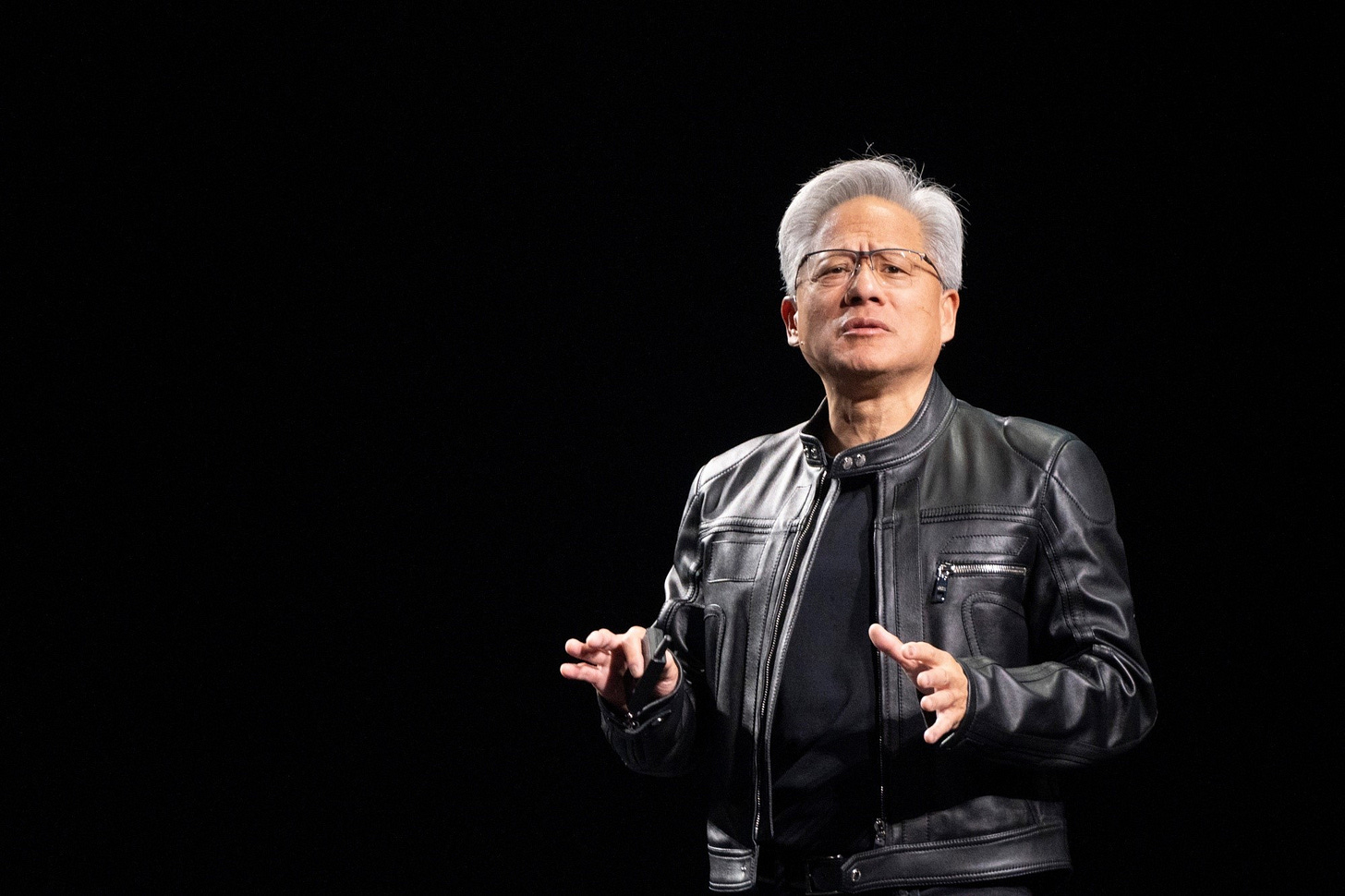

Nvidia plans to launch a new artificial intelligence chip designed specifically for China as soon as September, with chief executive Jensen Huang planning a visit to the mainland to reassert the company’s commitment to the country. The chip is a version of Nvidia’s existing Blackwell RTX Pro 6000 processor modified to meet Donald Trump’s tightened export control rules. It would be stripped of the most advanced technologies, such as high-bandwidth memory and NVLink, which improves interconnections for faster data transfers.

A gauge of Chinese property shares jumped 11% Thursday, the most in nearly nine months, fuelled by speculation a high-level meeting will be held to help revive the struggling real estate sector. The rally followed unverified social media reports of a possible high-level meeting that some are speculating could signal a resumption of the development of shantytown areas. Potential measures may include the government speeding up the construction of new homes, offering monetary payouts to families and pumping more money into smaller cities to bolster demand.

Nvidia To Launch New AI Chip For China

Nvidia plans to launch a new artificial intelligence chip designed specifically for China as soon as September, with chief executive Jensen Huang planning a visit to reassert the company’s commitment to the country, the Financial Times reported Thursday. The chip is a version of Nvidia’s existing Blackwell RTX Pro 6000 processor modified to meet Donald Trump’s tightened export control rules. It would be stripped of the most advanced technologies, such as high-bandwidth memory and NVLink, which improves interconnections for faster data transfers.

Nvidia’s clients in China have been testing samples of the chip and expressed interest in significant orders, according to FT sources. However, Chinese clients have grown concerned about the risk of relying too much on Nvidia products amid US policy uncertainties.

Nvidia’s chief plans to meet top Chinese leaders as he attends the International Supply Chain Expo in Beijing starting next Wednesday, according to people familiar with his schedule. He is expected to reaffirm Nvidia’s commitment to the Chinese market in the face of multiple rounds of export restrictions.

On Wednesday, Nvidia became the first company to hit a US$4 trillion market capitalisation. The California-based company, which was founded in 1993, first passed the US$2 trillion mark in February 2024, and surpassed US$3 trillion in June. Nvidia stock has risen by more than 40% since early May, when Trump first signalled a thaw in his trade war with China and Nvidia struck a series of multibillion-dollar chip deals in the Middle East. The stock has risen more than 1,000% since the beginning of 2023 and Nvidia now accounts for 7.5% of the S&P 500 Index.

TSMC Revenue Climbs 39%

Taiwan Semiconductor Manufacturing Co.'s (TSMC) revenue surged in June, bolstering expectations for a sustained post-ChatGPT boom in AI spending. The chipmaker saw sales climb 39% to US$32 billion for the second quarter, based on reported monthly revenue, beating analyst estimates. Investors have piled back into AI-linked companies, shaking off a malaise after China’s DeepSeek cast doubt on whether the likes of Meta and Google needed to spend that much money on data centres.

TSMC Chief Executive Officer C.C. Wei said AI chip demand still outstrips supply, and the company has pledged to spend US$100 billion ramping up manufacturing. He reaffirmed an outlook for 2025 sales to grow in the mid-20% range. According to Charles Shum, analyst at Bloomberg Intelligence, TSMC likely hit the high end of its US$29.2 billion 2Q sales guidance thanks to AI-driven demand from key chip designers such as Nvidia. TSMC has pledged to spend another US$100 billion ramping up manufacturing in Arizona, in addition to an expansion in Japan, Germany and back home.

Samsung Plans To Unveil Its First Trifold Smartphone In 2025

Samsung plans to sell a trifold smartphone later this year. The company’s consumer electronics chief TM Roh disclosed the plan at an event in New York, where Samsung unveiled three foldable smartphones as part of a strategy to reinforce its leadership in the category. Samsung is gearing up to compete with Huawei while attracting users ahead of Apple’s anticipated entry into the foldables market next year.

Bank Of Korea Leaves Interest Rates On Hold

South Korea’s central bank left interest rates on hold at 2.5% as expected Thursday, as it assesses the impact of recent measures aimed at cooling Seoul’s housing market. The Bank of Korea (BOK) noted a “significant acceleration in housing prices in Seoul and its surrounding areas, as well as household debt.” Housing prices in Seoul spiked over 19% in June on an annualized basis prompting authorities to step in with measures to address rapidly expanding household loans. The BOK on Thursday said it was critical to evaluate the effect of macro policies given the rise in risks associated with the housing market in Seoul and rising household debt, while also “remaining cautious about the possibility of heightened volatility in the foreign exchange market.”

“The BOK wants to cut rates to boost the economy, but it is concerned that lower rates will create bubbles in the property market, hurting financial stability,” said Park Chong-hoon, head of research at Standard Chartered in Seoul. “The runaway property market in Seoul and high household debt are limiting their policy options.”

The BOK had lowered rates in its last policy meeting in May at a time when the country was in the midst of political turmoil while also facing steep tariffs on auto and steel exports from the US. While South Korea’s economy contracted by 0.2% quarter-on-quarter in the first three months of this year amid softening exports growth and weak construction activity, the central bank chose to keep rates steady, prioritizing financial stability over growth concerns. South Korea faces economic headwinds as Donald Trump has threatened to impose 25% tariffs on all South Korean imports starting August 1, if the country fails to reach a trade deal with Washington.

Japan Producer Prices Rise The Least In 10 Months

Producer prices in Japan rose 2.9% y/y in June, slowing from a marginally revised 3.2% growth in the prior month and matching market forecasts. This was the lowest producer inflation since August 2024. On a monthly basis, producer prices fell 0.2%, the second straight month of declines, after a downwardly revised 0.1% drop in May.

Malaysia Maintains Lowest Jobless Rate In A Decade

Malaysia’s unemployment rate dropped to 3.0% in May from 3.3% in the same month a year earlier, marking its lowest level since April 2015 for the second consecutive month. The number of unemployed persons fell 5.7% year-on-year to a more than five-month low of 522,400, while employment rose 2.9% to a record high of 16.86 million. The labour force participation rate increased to an all-time high of 70.8% in May, up from 70.6% a year earlier and the second successive month at this record level.

US Initial Unemployment Claims Fall For Fourth Week

Fewer Americans are making new filings for unemployment benefits. In the week through July 5, initial jobless claims fell to 227,000, from a revised 232,000 a week earlier. Economists polled by The Wall Street Journal had forecast 235,000 claims. It was the fourth consecutive decline in initial claims to the lowest count in seven weeks, supporting the view that the US labour market remains relatively robust even with high interest rates and economic uncertainty.

Continuing claims, a measure of the total unemployed population, ticked up to 1.97 million, the US Labor Department said Thursday. That is the highest since November 2021, signalling relatively slow hiring is making it harder for people out of work to find new jobs. Continuing-claims data lags initial claims by a week.

China Car Sales Rise 13.8% In June

China's vehicle sales grew by 13.8% year-on-year to 2.904 million units in June, following an 11.2% increase in May, according to data from the China Association of Automobile Manufacturers (CAAM). Sales of new energy vehicles (NEVs) surged 26.7% in June, marking the fourth consecutive monthly increase. In the first half of 2025, total vehicle sales climbed 11.4% to 15.65 million units, with NEV sales jumping 40.3% to 6.94 million units. NEVs accounted for 44.3% of total new car sales. On a monthly basis, total car sales increased 8.1% in June, after a 3.7% gain in May.

22 Countries Receive Tariff Letters From Trump

22 nations have so far received letters from President Trump setting new tariff levels from the start of August. The countries that received letters Monday and Wednesday, and the rates they face are:

● Brazil: 50%

● Laos, Myanmar: 40%

● Cambodia, Thailand: 36%

● Bangladesh, Serbia: 35%

● Indonesia: 32%

● Algeria, Bosnia & Herzegovina, Iraq, Libya, South Africa, Sri Lanka: 30%

● Brunei, Japan, Kazakhstan, Malaysia, Moldova, South Korea, Tunisia: 25%

● The Philippines: 20%

Donald Trump Threatens To Impose 50% Tariff On Brazil

Donald Trump has threatened to hit Brazil with tariffs of 50% and accused it of attacking free speech and treating former president Jair Bolsonaro unfairly, in a significant escalation of tensions between the US and Latin America’s biggest economy. In a letter posted to Truth Social Thursday, Trump said that the trial of Bolsonaro over an alleged coup plot was a “Witch Hunt that should end IMMEDIATELY!” He added that the tariff, to be effective from August 1, would be applied partly because of Brazil’s “insidious attacks on Free Elections, and the fundamental Free Speech Rights of Americans”. He also accused Brazil’s Supreme Court of issuing “hundreds of SECRET and UNLAWFUL Censorship Orders” against US social media platforms.

Brazilian President Luiz Inácio Lula da Silva stressed in a lengthy response on X that Brazil was "a sovereign country with independent institutions and will not accept any tutelage". The Brazilian leader also announced that "any unilateral tariff increases" would be met with reciprocal tariffs imposed on US goods. He signalled his country was ready to respond using a law that enables Brasília to retaliate against trade barriers imposed on its exports. Brazil’s vice-president and trade minister Geraldo Alckmin said his country did not pose a problem for the US, adding that “the US does have a trade deficit, but it has a surplus with Brazil”. DAta shows the US had a goods trade surplus with Brazil of US$7.4bn in 2024. The US is Brazil's second-largest trade partner after China, so the hike from a tariff rate of 10% to 50%, if it comes into force, would hit the South American nation hard.

Arabica coffee prices trading in New York climbed more than 3.5% on Thursday in response to Trump’s threat, before paring gains to trade around 2.5%. Brazil is the world’s top producer of arabica coffee, which is used in higher-end brews. The letter is “sending shockwaves across the coffee industry”, said a trader. “The US is Brazil’s main coffee buyer, so this tariff will certainly hit sentiment.”

Prices of arabica and robusta coffee have been strong over the past few years as poor harvests in the world’s main growing countries, Brazil and Vietnam, have reduced supplies and speculators have piled into the market. London robusta futures, the global benchmark, reached a record high of nearly $5,700 a tonne earlier this year, up from a historical average of $1,700, while the price of higher end arabica coffee beans rose 70% last year to $4.20 a pound.

Philippines Plans US Talks As Higher Tariff Rate Sparks Concern

The Philippines will hold further trade negotiations with the US after Donald Trump increased the planned tariff rate to 20%. The Department of Trade and Industry said, "we are concerned that, notwithstanding our efforts and constant engagements, the US still decided to impose a 20% tariff on Philippine exports". A Philippine delegation led by Frederick Go, special assistant to the president for investment and economic affairs, will meet with US counterparts next week, Go said at a briefing on Thursday. He led trade officials during the initial round of talks in May in Washington. Go said the Philippines will aim to convince Washington to lower the rate, which was increased from the 17% announced in April, but cannot offer the US a zero tariff in exchange.

Manila’s 20% level is on par with Vietnam and near Brunei’s 25%. The US had a trade deficit with the Philippines of US$4.9 billion last year amid total trade of US$23.5 billion, according to US government data. That compares with a deficit of US$45.6 billion with Thailand and US$123.5 billion with Vietnam.

Copper Market In Turmoil As US Confirms 50% Tariff On Imports

Donald Trump has sowed chaos in metals markets by confirming the US would implement a higher-than-expected 50% tariff on copper imports from August 1, spurring a record spike in New York futures. Contracts on the Comex surged to an unprecedented 138% premium over London Metal Exchange prices, the global benchmark, in the aftermath of Trump’s comments. It means that US consumers could be paying around $15,000 per metric ton for copper, while the rest of the world pays around $10,000, assuming the 50% tariff rate comes into effect at the start of the month. Analysts say this huge discrepancy will start to have a major economic impact in the US. “America will, once again, build a DOMINANT Copper Industry,” Trump wrote on Truth Social. However, the move is likely to hurt American producers of everything from automobiles to appliances that rely on the metal.

Copper traders are scrambling to get cargoes into the US before the new tariff comes into effect. Some are looking to shift deliveries into Hawaii and Puerto Rico to cut shipment times. Shipments from Asia to New Orleans typically take over a month, so any traders sending metal now would risk being caught on the wrong side of the tariff. The journey to Hawaii meanwhile is roughly ten days.

Ever since Trump first announced plans to put tariffs on copper in February, the resulting surge in US prices prompted an industry-wide dash to deliver metal into the US. As a result, stockpiles inside the country have soared, while the rest of the world faces a mounting supply squeeze. Copper futures rose Thursday after falling slightly in the previous session. Futures gained 2.6% Thursday to close the day at $5.6275 a pound. Prices for the metal hit record highs Tuesday after the president unveiled the levy.

Billionaire mining entrepreneur Robert Friedland welcomed Trump’s vow to impose a 50% tariff on copper imports, arguing that domestic production of the metal was “fundamental to America’s national security”. “There’s a new list of critical raw materials and without it, you can’t do anything about global warming or greening the world economy and you have a critical vulnerability in national security,” industry veteran Friedland told the Financial Times. “I commend the Trump administration for doing what’s obvious and intelligent — America needs to produce the metal,” he said. Friedland, 74, dismissed any market reaction as “irrelevant”. “What’s really going on here is that the US wants the metal to be produced in the US, refined in the US — and not just copper. Copper is the paradigm for probably 30 critical metals.”

India Plans To Reduce Reliance On Chinese Rare Earths

India is moving to cut its reliance on China for rare-earth magnets, vital materials for electric vehicles and wind turbines. The government is planning an incentive program worth as much as 25 billion rupees (US$290mn) for private sector firms manufacturing these magnets, Bloomberg News reported. Billionaires are backing the effort with Anil Agarwal’s mining giant Vedanta Group, Sajjan Jindal-led JSW Group and EV parts maker Sona BLW Precision Forgings all showing interest. The programme aims to support the production of about 4,000 tons of neodymium and praseodymium-based magnets over a period of seven years, using locally mined raw materials, the report said.

India is accelerating its efforts after China, which controls about 90% of the world’s rare earths processing, tightened export controls on the components amid a trade war with the US. That disrupted supply chains for global automobile makers. Prime Minister Narendra Modi highlighted the need for a reliable supply of critical minerals at the BRICS gathering in Rio de Janeiro over the weekend, pledging to ensure “that no country uses these resources for its own selfish gain or as a weapon against others.”

Thaksin Confident Thai Court Will Clear Daughter’s Suspension As PM

Thaksin Shinawatra, the de facto leader of Thailand’s ruling party, expects a court to clear allegations of ethical misconduct against his daughter, Prime Minister Paetongtarn Shinawatra. Paetongtarn was suspended from office by the Constitutional Court after a group of senators alleged she violated ethical standards in a leaked phone call. Thaksin says his family-backed Pheu Thai Party will either nominate another candidate for prime minister or dissolve parliament to call an early election if Paetongtarn is ousted by the court.

Paetongtarn is the youngest of Thaksin’s three children and the third member of the influential Shinawatra clan to become Thailand’s prime minister. She was suspended from office by the country’s Constitutional Court until it ruled on a petition by a group of senators, who alleged she had violated ethical standards by blaming the Thai army for escalating a border dispute in a leaked phone call with former Cambodian leader Hun Sen. “I’m confident in my daughter’s good intentions, and I trust the court will consider the facts with reason,” Thaksin told local broadcaster Nation TV, when asked about the allegations against Paetongtarn. “Everything can be explained.”

Rubio Meets Lavrov At ASEAN Summit

US Secretary of State Marco Rubio met his Russian counterpart Sergei Lavrov Thursday on the sidelines of an Association of Southeast Asian Nations gathering in Kuala Lumpur. The meeting came as Russia pounded Kyiv and other Ukrainian cities with record numbers of drones and missiles Thursday. The attack lasted nearly 10 hours and involved about 400 attack drones and 18 missiles, according to Ukrainian President Volodymyr Zelenskyy. The main target of the attack was Kyiv and the surrounding region, he said.

After a 50-minute conversation with Lavrov, Rubio said he would tell President Trump about “a new and different approach” to peace talks raised in the meeting. “We need to see a road map moving forward about how this conflict can conclude, and we shared some ideas about what that might look like,” Rubio said, while declining to provide details. In a written statement, the Russian Foreign Ministry said Rubio and Lavrov had a “substantive and frank” conversation that also touched on Iran and Syria.

Donald Trump recently reiterated his displeasure with Vladimir Putin over the war in Ukraine and confirmed he’s sending more defensive weapons, including air-defence missiles, artillery shells and other hardware to President Volodymyr Zelenskiy’s government. At a Cabinet meeting this week, Trump said he’s looking “very strongly” at a bill introduced in the Senate that would impose severe sanctions on Russia and on countries that purchase its oil, petroleum products, natural gas or uranium.

Asia-Pacific Markets Mixed After Latest Tariff Letters

Asia-Pacific markets traded mixed on Thursday as traders assessed the Bank of Korea’s decision to keep rates steady, as well as Donald Trump’s latest tariff rates on several countries which are due to go into effect on August 1. Trump also said Wednesday that the 50% tariff on copper imports, which he had announced the previous day, will take effect on August 1. However, the latest tariff headlines did little to dent investor confidence.

Japan’s Nikkei 225 slipped 0.4% to close at 39,646 as trade talks with the US remain stalled. South Korea’s Kospi added 1.6%. Australia’s S&P/ASX 200 rose 0.6%. In India, the BSE Sensex fell 0.4% to close at 83,190.

Singapore’s benchmark Straits Times Index reached another new high Thursday, notching its fourth straight day of gains. The country’s benchmark index closed at a fresh record of 4,075.85 points, up 0.4% on the day.

Property Shares Lead Chinese Stocks Higher

Chinese and Hong Kong-listed stocks ended the day higher Thursday. The mainland’s CSI 300 was up 0.5% at 4,010. Hong Kong’s Hang Seng Index rose 136 points, or 0.6%, to close at 24,028. The Hang Seng Tech Index fell 0.3%.

A gauge of Chinese property shares jumped the most in nearly nine months, fuelled by speculation a high-level meeting will be held to help revive the struggling sector. A Bloomberg Intelligence index of the nation’s real estate stocks surged as much as 11%, with Logan Group rising almost 21% in Hong Kong, after surging 85% earlier in the day, and Sino-Ocean Group closing over 27% higher. The rally followed unverified social media reports of a possible high-level meeting that some are speculating could signal a resumption of the development of shantytown areas. The market is betting China will dust off its 2015 playbook to support so-called shanty-town redevelopment. Potential measures may include the government speeding up the construction of new homes, offering monetary payouts to families and pumping more money into smaller cities to bolster demand.

The latest high-level meeting is reminiscent of the Central Urban Work Conference held in 2015, which sought to boost urban planning and infrastructure. That event was the first of its kind in decades and was attended by President Xi Jinping, former Premier Li Keqiang and all the members of the Politburo’s standing committee. China's property sector is mired in a protracted slump, with officials having taken steps to try and revive the sector, but these have so far had only modest success

Mining Firms Lift FTSE 100 To Record High

European stocks closed higher Thursday for the fourth consecutive day as investors digested a slew of US tariff updates, though not yet one for the European Union, as negotiators scramble to strike a framework trade agreement. Signs of continued economic strength, prospects for the upcoming earnings season and optimism for AI have given traders the conviction to drive equities higher.

The pan-European Stoxx 600 was up 0.5%, with most sectors and regional bourses in the green. Mining stocks led gains on the Stoxx 600, with the sector up 3.2%, lifting the UK’s FTSE 100 above a record intraday high set in March. The index was up 1.2% on the day.

Shares of Anglo American (+3.8%), Rio Tinto (+4.0%) and Glencore (+3.9%) all rose. The firms all have significant copper operations and could benefit from Donald Trump’s announcement Wednesday that 50% duties will be slapped on the metal from August 1. The news has sent US copper prices soaring and is likely to signal increased government support for mining projects in the country. Trump’s surprise Tuesday announcement of a 50% rate, at the highest end of traders’ expectations, sharply jolted the copper market, with the premium paid by US buyers over the rest of the world more than doubling to a record over $2,600.

The annual inflation rate in Germany fell to 2% in June, the lowest in eight months, from 2.1% in each of the previous two months, and in line with the preliminary estimate. "In addition to the continued decline in energy prices, food price inflation slowed in particular. On the other hand, the above-average increase in service prices continued to drive up inflation", the President of the Federal Statistical Office said.

US Stocks Close At Record Highs

On Wall Street Thursday, investors shrugged off President Trump’s latest tariff broadside targeting Latin America's biggest nation. The three major indices rose, with the S&P 500 and Nasdaq composite hitting new records, despite Trump unveiling a 50% tariff on Brazilian goods. The S&P 500 gained 0.3% to end the day at 6,280. The tech-heavy Nasdaq closed up 0.1% to 20,631, hitting a record for the second day in a row. The Dow added 192 points, or 0.4%, to finish at 44,651. The iShares MSCI Brazil ETF (EWZ) shed 1.6% on Thursday.

Taiwan Semiconductor Manufacturing (TSMC), the world's largest contract chip maker, reported a 40% jump in January-June revenue from a year earlier. Shares fell 0.9% Thursday.

The Italian candy maker behind Ferrero Rocher is close to buying the cereal conglomerate WK Kellogg for about US$3 billion, the Wall Street Journal reported. Shares in Kellogg surged over 30%.

Second quarter earnings season kicked off with Delta Air Lines cutting its 2025 profit forecast as it deals with lower-than-expected demand this year and the industry manages a glut of flights, but the carrier’s outlook for summer travel beat Wall Street’s expectations. Delta expects adjusted earnings per share of between $1.25 and $1.75 in the third quarter, compared with Wall Street analysts’ forecast for $1.31 a share. It also said it expects revenue that’s flat to up 4%, topping forecasts for a 1.4% sales increase. Delta shares jumped 12% after releasing results. Other airlines’ shares also rose after Delta’s report.

US 10-Year Yield Holds Decline

The yield on the 10-year US Treasury note held around 4.35% on Thursday, stabilizing after a sharp decline in the previous session, driven by strong demand in a 10-year bond auction. Minutes from the Federal Reserve’s latest meeting also revealed that most policymakers were open to cutting interest rates later this year.

US Dollar Unchanged

The US dollar index was unchanged at 97.60 on Thursday, as investors pivoted toward riskier assets amid a broad rally in stocks and commodities. The Japanese yen appreciated 0.2% to ¥146.22 per dollar on Thursday, extending gains from the previous session as the US dollar weakened amid a sharp drop in Treasury yields. The offshore yuan was steady around Rmb 7.18 per dollar on Thursday, as investors assessed the latest inflation data from China.

Gold Extends Gains

Gold rose 0.3% to $3,324 per ounce on Thursday, extending gains from the previous session, supported by a weaker dollar as investors continued to monitor trade developments and digested the latest FOMC minutes.

Brent Falls On Demand Risks

Brent crude oil futures fell 1.8% to $68.84 per barrel on Thursday, weighed by growing concerns over broader trade disruptions that could dampen oil demand. The market remains focused on a series of tariff demand letters from President Trump, with Brazil the latest target of steep duties, following earlier threats on copper imports and other nations. Adding to the pressure, the EIA reported a 7.1-million-barrel build in crude stocks last week, defying expectations of a 2.1-million-barrel draw. Meanwhile, OPEC+ is set for another major output increase in September as eight members unwind voluntary cuts. However, Bloomberg News reported Thursday that OPEC+ is discussing a pause in further production increases from October after its next monthly hike.

Bitcoin Hits Record High

The price of Bitcoin hit a new record above $113,000 Wednesday. It reached a high of $113,863. The cryptocurrency rose 2.6% on the day to US$113,740, pushing its gain this year close to 22%. Bitcoin has traded in a tight range for several weeks despite billions of dollars flowing into bitcoin exchange traded funds, which has helped the price stay above the $100,000 level for more than 60 consecutive days.

Peter Lewis’ Money Talk Podcast

On Friday’s “Peter Lewis’ Money Talk” podcast, I’ll be joined by David Roche, President & Global Strategist at Quantum Strategy and Andrew Sullivan, founder of Asian Market Sense. With a view from Australia is Toby Lawson, the former head of Statton Partners in Sydney Australia.

The podcast is also available on Apple Podcasts, YouTube Studio and Spotify.

Spotify

YouTube Studio

https://www.youtube.com/playlist?list=PLnwqOJD9ie5gHH29bNfuG1Nscy8rdJo6O

Apple Podcasts

This podcast is sponsored by Surfin Group, which is headquartered in Singapore and offers online financial services to 60 million customers across 10 countries. You can find out more about them by going to their website www.surfin.sg